The carbon credit market has emerged as a pivotal mechanism in the global effort to combat climate change. It operates on the principle of cap-and-trade, where governments or regulatory bodies set a limit on greenhouse gas emissions and allocate a corresponding number of carbon credits to companies. Each credit represents the right to emit one ton of carbon dioxide or its equivalent in other greenhouse gases. Companies that reduce their emissions below their allocated credits can sell their surplus credits to others that exceed their limits, creating a financial incentive for reducing overall emissions. This market-based approach aims to encourage innovation and investment in cleaner technologies while providing flexibility for businesses to meet their environmental obligations.

As awareness of climate change grows, so does the complexity and scale of the carbon credit market. Various stakeholders, including governments, corporations, and non-governmental organizations, are increasingly involved in this space. The market has expanded beyond compliance credits, which are mandated by law, to include voluntary credits that companies purchase to offset their emissions voluntarily. This expansion has led to a diverse range of projects aimed at generating carbon credits, from reforestation initiatives to renewable energy projects. However, the market also faces challenges related to transparency, verification, and fraud, which can undermine its effectiveness in achieving genuine emissions reductions.

In exploring the transformative impact of blockchain technology on the carbon credit market, it’s essential to consider how innovative approaches can revitalize struggling enterprises. A related article titled “To Buy Time for a Failing Startup, Recreate the Engineering Process” delves into strategies that can help businesses adapt and thrive in challenging environments. By understanding the intersection of technology and business resilience, we can better appreciate the broader implications of blockchain in various sectors. For more insights, you can read the article here: To Buy Time for a Failing Startup, Recreate the Engineering Process.

Key Takeaways

- Blockchain enhances transparency and traceability in carbon credit trading.

- It reduces fraud and double counting by providing a secure, immutable ledger.

- Challenges include regulatory uncertainty and technological scalability issues.

- Successful case studies demonstrate improved efficiency and trust in carbon markets.

- Future growth depends on supportive policies and integration with existing systems.

The Role of Blockchain in Carbon Credit Trading

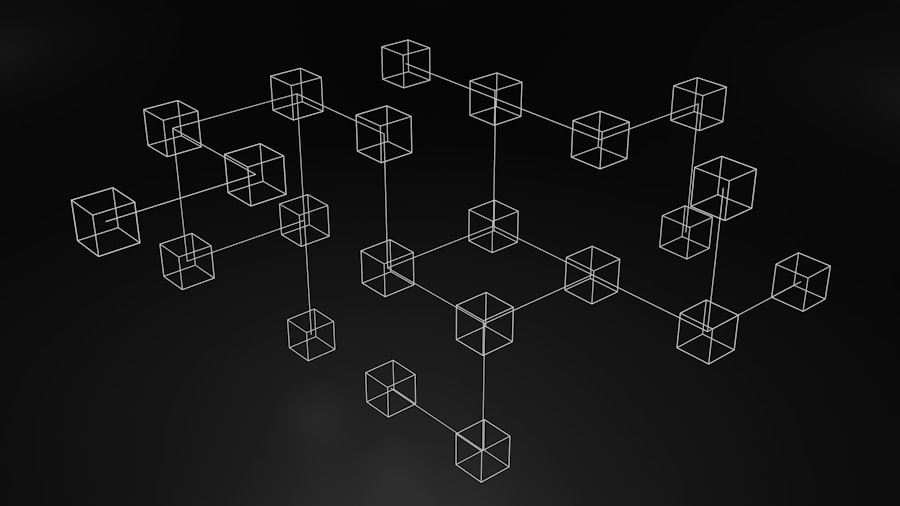

Blockchain technology has the potential to transform the carbon credit market by enhancing transparency and efficiency in trading processes. At its core, blockchain is a decentralized digital ledger that records transactions across multiple computers in a way that ensures security and immutability. This characteristic makes it particularly suitable for tracking carbon credits, as it can provide a verifiable record of each transaction from issuance to retirement. By utilizing blockchain, stakeholders can access real-time data on carbon credit transactions, which can help build trust among participants and reduce the risk of double counting or fraud.

Moreover, blockchain can facilitate the automation of various processes within the carbon credit market through smart contracts. These self-executing contracts are programmed to automatically enforce the terms of an agreement when certain conditions are met. For instance, a smart contract could automatically transfer carbon credits from one party to another once a project has been verified as having achieved its emissions reduction goals. This automation not only streamlines transactions but also reduces administrative costs and the potential for human error, making the trading process more efficient.

Advantages of Using Blockchain in the Carbon Credit Market

One of the primary advantages of integrating blockchain technology into the carbon credit market is enhanced transparency. Each transaction recorded on a blockchain is visible to all participants in the network, which helps ensure that all parties have access to the same information. This transparency can significantly reduce the potential for fraud and manipulation, as stakeholders can independently verify the authenticity of carbon credits. Additionally, it allows for better tracking of the lifecycle of each credit, from its creation through its trading history to its eventual retirement.

Another significant benefit is improved efficiency in trading processes. Traditional carbon credit markets often rely on intermediaries for verification and transaction processing, which can introduce delays and additional costs. By leveraging blockchain’s decentralized nature, these intermediaries can be minimized or eliminated altogether. This not only speeds up transactions but also lowers costs for buyers and sellers alike. Furthermore, the use of smart contracts can automate compliance checks and reporting requirements, further streamlining operations within the market.

Challenges and Limitations of Blockchain in Carbon Credit Trading

Despite its potential benefits, the integration of blockchain into the carbon credit market is not without challenges. One major concern is the scalability of blockchain solutions. As the volume of transactions increases, maintaining a fast and efficient network can become difficult. Many existing blockchain platforms face limitations in transaction throughput, which could hinder their ability to handle large-scale trading activities typical in carbon markets.

Additionally, there are regulatory uncertainties surrounding the use of blockchain technology in carbon credit trading. Different jurisdictions have varying regulations regarding carbon credits and digital assets, which can complicate cross-border transactions. The lack of standardized protocols for blockchain implementation in this context may also lead to fragmentation within the market, making it challenging for participants to navigate different systems and requirements. Addressing these regulatory hurdles will be crucial for widespread adoption of blockchain solutions in carbon credit trading.

As the conversation around sustainability and carbon credits continues to evolve, it’s interesting to explore how technology is playing a pivotal role in this transformation. A related article discusses the best software to create training videos, which can be instrumental for organizations looking to educate their teams about the intricacies of carbon markets and blockchain technology. By leveraging effective training tools, companies can better understand how blockchain is disrupting the carbon credit market and implement strategies that align with their sustainability goals. For more insights, you can check out the article on best software to create training videos.

Case Studies of Successful Implementation of Blockchain in Carbon Credit Market

| Metric | Traditional Carbon Credit Market | Blockchain-Enabled Carbon Credit Market |

|---|---|---|

| Transaction Transparency | Low – Limited visibility, prone to fraud | High – Immutable ledger with full traceability |

| Verification Time | Weeks to months | Minutes to hours |

| Intermediaries | Multiple brokers and registries | Reduced or eliminated via smart contracts |

| Market Accessibility | Restricted to large corporations and governments | Open to individuals and small businesses globally |

| Fraud and Double Counting | High risk due to lack of centralized tracking | Minimized through decentralized verification |

| Cost of Transactions | High due to intermediaries and paperwork | Lower due to automation and reduced intermediaries |

| Liquidity | Low – Limited trading platforms | Higher – Tokenized credits enable easier trading |

| Data Integrity | Vulnerable to manipulation | Secured by cryptographic methods |

Several initiatives have successfully demonstrated the application of blockchain technology in carbon credit trading. One notable example is the partnership between IBM and Veridium Labs, which aims to create a blockchain-based platform for tokenizing carbon credits derived from reforestation projects. This platform allows companies to purchase tokens representing verified carbon credits directly from projects that contribute to environmental sustainability.

By leveraging blockchain’s transparency and traceability features, this initiative enhances trust among buyers while ensuring that funds are directed toward legitimate projects.

Another significant case is the Energy Web Foundation’s development of a blockchain platform designed specifically for renewable energy and carbon markets. This platform enables users to track renewable energy generation and associated carbon credits in real-time. By providing a decentralized infrastructure for trading these credits, it empowers consumers and businesses to engage more actively in carbon offsetting efforts. The success of such initiatives illustrates how blockchain can facilitate more efficient and transparent trading mechanisms within the carbon credit market.

Blockchain technology is not only transforming the carbon credit market but is also influencing various sectors by enhancing transparency and efficiency. For a deeper understanding of this phenomenon, you can explore an insightful article on the impact of blockchain in environmental sustainability. This article delves into how decentralized systems are revolutionizing traditional practices, making them more accountable and accessible. To read more about this topic, check out the article Blockchain’s ability to provide a secure and verifiable record of transactions positions it well to meet this demand. Moreover, advancements in technology may address some current limitations associated with blockchain scalability and interoperability. As new platforms emerge and existing ones evolve, there is potential for greater integration across different systems within the carbon credit market. This could lead to a more cohesive trading environment where participants can easily transact across borders and jurisdictions while adhering to varying regulatory requirements. The integration of blockchain technology into carbon credit trading raises important regulatory and policy considerations that must be addressed for successful implementation. Policymakers will need to establish clear guidelines regarding the use of blockchain for tracking and trading carbon credits to ensure compliance with existing environmental regulations. This may involve creating standards for data reporting, verification processes, and auditing practices specific to blockchain applications. Furthermore, international cooperation will be essential as carbon markets often operate across borders. Regulatory and Policy Implications of Blockchain in Carbon Credit Trading

The Potential Impact of Blockchain on Carbon Credit Market

In conclusion, blockchain technology holds significant potential to enhance the efficiency, transparency, and trustworthiness of the carbon credit market. By providing a decentralized platform for tracking transactions and automating processes through smart contracts, blockchain can address many challenges currently faced by traditional trading systems. While there are hurdles related to scalability and regulatory frameworks that must be navigated, successful case studies demonstrate that innovative solutions are already being developed.

As global efforts to combat climate change intensify, integrating blockchain into carbon credit trading could play a crucial role in facilitating more effective emissions reduction strategies. The ongoing evolution of this technology will likely shape the future landscape of carbon markets, making them more accessible and reliable for all participants involved. Ultimately, harnessing blockchain’s capabilities could lead to a more robust framework for achieving sustainability goals on a global scale.

FAQs

What is the carbon credit market?

The carbon credit market is a system where companies or individuals can buy and sell carbon credits, which represent the right to emit a certain amount of carbon dioxide or other greenhouse gases. It is designed to incentivize the reduction of emissions by putting a price on carbon.

How does blockchain technology work in the carbon credit market?

Blockchain technology provides a decentralized and transparent ledger that records all transactions related to carbon credits. This ensures the authenticity, traceability, and security of carbon credit data, reducing fraud and double counting.

What are the main benefits of using blockchain in the carbon credit market?

Blockchain enhances transparency, improves trust among participants, streamlines the verification process, reduces administrative costs, and enables real-time tracking of carbon credit issuance and trading.

Can blockchain help in verifying the authenticity of carbon credits?

Yes, blockchain can securely record the origin and ownership history of carbon credits, making it easier to verify their authenticity and prevent issues like double counting or fraudulent claims.

Are there any challenges in implementing blockchain for carbon credit trading?

Challenges include the need for standardization across platforms, regulatory acceptance, integration with existing systems, and ensuring data accuracy from external sources (oracles) that feed information into the blockchain.