In recent years, Asia has witnessed a remarkable transformation in the financial services landscape, primarily driven by the emergence of financial super apps. These multifunctional platforms have revolutionized how consumers manage their finances, conduct transactions, and access a wide array of services. The rise of super apps can be attributed to several factors, including the rapid adoption of smartphones, increasing internet penetration, and a growing demand for convenience among consumers.

Countries like China, India, and Southeast Asian nations have become fertile ground for these applications, which integrate various financial services into a single user-friendly interface. The success of financial super apps in Asia can also be linked to the region’s unique socio-economic dynamics. For instance, in China, platforms like WeChat and Alipay have not only facilitated peer-to-peer payments but have also expanded into areas such as e-commerce, insurance, and investment services.

This all-in-one approach has resonated with users who prefer the convenience of accessing multiple services without switching between different applications. Similarly, in India, apps like Paytm and PhonePe have gained traction by offering a suite of financial services that cater to the needs of a diverse population, from urban professionals to rural farmers. The rise of these super apps signifies a shift towards a more integrated financial ecosystem that prioritizes user experience and accessibility.

Key Takeaways

- Financial super apps are on the rise in Asia, offering a wide range of financial services in one platform.

- Key features and services offered by financial super apps include banking, investing, lending, insurance, and more.

- Financial super apps are disrupting traditional banking by providing convenient and accessible financial services to consumers.

- The impact of financial super apps on consumer behavior is significant, as they are changing the way people manage their finances and make transactions.

- Regulatory challenges and opportunities exist for financial super apps, as they navigate the complex landscape of financial regulations in different countries.

Key Features and Services Offered by Financial Super Apps

Financial super apps are characterized by their extensive range of features and services that cater to various aspects of personal finance. At their core, these applications typically offer digital wallets for seamless transactions, enabling users to send and receive money instantly. Beyond basic payment functionalities, many super apps incorporate features such as bill payments, mobile recharges, and even QR code scanning for in-store purchases.

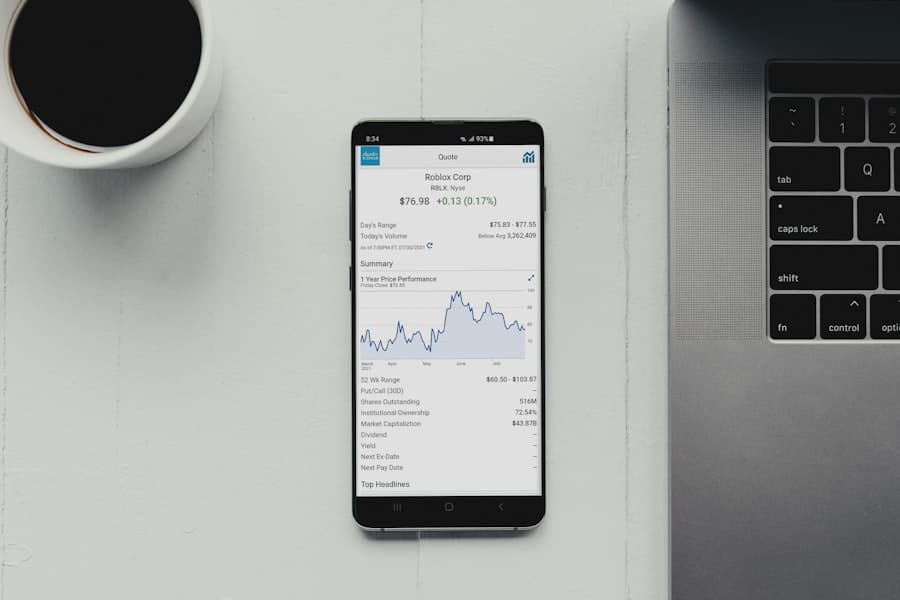

This versatility allows users to manage their day-to-day financial activities efficiently. Moreover, financial super apps often provide additional services that extend beyond mere transactions. For instance, many platforms now include investment options, allowing users to trade stocks, mutual funds, or cryptocurrencies directly within the app.

This democratization of investment opportunities has made it easier for individuals to grow their wealth without needing extensive financial knowledge or access to traditional brokerage services. Furthermore, some super apps have ventured into lending services, offering microloans or credit facilities based on users’ transaction histories and credit scores. This integration of various financial services into a single platform not only enhances user convenience but also fosters greater financial inclusion by reaching underserved populations.

How Financial Super Apps are Disrupting Traditional Banking

The rise of financial super apps has posed significant challenges to traditional banking institutions, fundamentally altering the competitive landscape of the financial services industry.

With super apps offering instant transactions, low fees, and user-friendly interfaces, customers are increasingly reluctant to engage with traditional banks that may have cumbersome processes and outdated technology.

This shift has compelled banks to reevaluate their service offerings and adopt more agile approaches to meet evolving consumer demands. Additionally, super apps are leveraging advanced technologies such as artificial intelligence and machine learning to enhance their services further. These technologies enable personalized recommendations based on user behavior and preferences, creating a tailored experience that traditional banks often struggle to replicate.

For example, super apps can analyze spending patterns to suggest budgeting tips or investment opportunities that align with users’ financial goals. As a result, traditional banks face pressure not only to innovate but also to rethink their customer engagement strategies in an increasingly digital world.

The Impact of Financial Super Apps on Consumer Behavior

The proliferation of financial super apps has significantly influenced consumer behavior in various ways. One of the most profound changes is the increased reliance on digital platforms for managing finances. Consumers are now more inclined to use their smartphones for everyday transactions rather than relying on cash or physical bank branches.

This shift has been particularly pronounced among younger generations who prioritize convenience and speed in their financial interactions. As a result, cash usage has declined in many urban areas across Asia, with digital payments becoming the norm. Moreover, the accessibility of financial services through super apps has empowered consumers to take greater control over their financial well-being.

With features like budgeting tools and investment tracking integrated into these platforms, users can make informed decisions about their spending and saving habits. This newfound financial literacy is fostering a culture of proactive money management among consumers who previously may have felt overwhelmed by complex financial products offered by traditional institutions. Consequently, the rise of super apps is not just changing how people transact; it is also reshaping their attitudes toward personal finance and investment.

Regulatory Challenges and Opportunities for Financial Super Apps

As financial super apps continue to gain traction in Asia, they face a myriad of regulatory challenges that could impact their growth trajectory. One significant concern is the need for compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations. Given the vast amounts of data these platforms handle and the potential for misuse, regulators are increasingly scrutinizing how super apps manage user information and ensure secure transactions.

Failure to comply with these regulations could result in hefty fines or restrictions on operations. However, these regulatory challenges also present opportunities for innovation within the sector. As governments recognize the importance of fostering a competitive fintech landscape, they may introduce more favorable regulations that encourage collaboration between traditional banks and super apps.

For instance, regulatory sandboxes allow fintech companies to test new products in a controlled environment while ensuring consumer protection. Such initiatives can lead to enhanced trust in digital financial services and pave the way for more robust partnerships between established banks and emerging fintech players.

The Role of Big Tech Companies in the Growth of Financial Super Apps

Big tech companies have played a pivotal role in the rapid expansion of financial super apps across Asia. With their vast resources, technological expertise, and extensive user bases, these companies are well-positioned to disrupt traditional financial services. For example, firms like Tencent and Alibaba have leveraged their existing ecosystems—social media platforms and e-commerce marketplaces—to seamlessly integrate financial services into their offerings.

This strategy not only enhances user engagement but also creates a comprehensive digital experience that keeps consumers within their platforms. Moreover, big tech companies bring a level of innovation that traditional banks often struggle to match. Their ability to harness data analytics allows them to develop personalized financial products tailored to individual user needs.

This data-driven approach enables super apps to offer competitive pricing on loans or investment products based on real-time insights into consumer behavior. As big tech continues to invest in fintech solutions, they are likely to further reshape the landscape of financial services in Asia and beyond.

The Future of Financial Super Apps in Asia and Beyond

Looking ahead, the future of financial super apps appears promising as they continue to evolve and adapt to changing consumer needs. One potential trend is the increasing integration of advanced technologies such as blockchain and artificial intelligence into these platforms. Blockchain technology could enhance security and transparency in transactions while enabling new forms of decentralized finance (DeFi) that challenge traditional banking models.

Meanwhile, AI-driven insights will likely become more sophisticated, allowing super apps to offer even more personalized financial advice and product recommendations. Furthermore, as competition intensifies among super app providers, we may see an expansion of services beyond finance into areas such as health care or travel booking. This diversification could create even more comprehensive ecosystems that cater to all aspects of consumers’ lives.

Additionally, as regulatory frameworks evolve to accommodate these innovations, we may witness greater collaboration between fintech companies and traditional banks as they seek to leverage each other’s strengths for mutual benefit.

How Traditional Financial Institutions are Responding to the Rise of Financial Super Apps

In response to the growing influence of financial super apps, traditional financial institutions are adopting various strategies to remain competitive in this rapidly changing landscape.

Many banks are investing heavily in technology upgrades to streamline operations and improve service delivery through mobile banking applications that rival those offered by super apps.

Moreover, some traditional banks are exploring partnerships with fintech companies or even acquiring them outright to gain access to innovative technologies and customer bases. By collaborating with agile startups that specialize in specific areas such as payments or lending, banks can enhance their service offerings without having to develop everything in-house. This strategy not only helps banks stay relevant but also fosters a culture of innovation that can lead to new product development tailored to meet evolving consumer demands.

As traditional institutions navigate this new landscape shaped by financial super apps, they must also focus on building trust with consumers through transparency and security measures. By prioritizing customer education around digital finance and emphasizing robust security protocols, banks can position themselves as reliable partners in an increasingly digital world while adapting to the challenges posed by emerging competitors.

In the rapidly evolving landscape of financial technology, the dominance of financial super apps in Asian markets is a testament to their ability to integrate a multitude of services into a single platform, offering unparalleled convenience to users. These apps are not only reshaping how consumers manage their finances but are also setting new standards for digital innovation. A related article that delves into the technological advancements driving such innovations is Unlock Your Creative Potential with the Samsung Galaxy Book Flex2 Alpha. This piece explores how cutting-edge technology, like that found in the Samsung Galaxy Book Flex2 Alpha, is empowering users to harness their creativity and productivity, much like how financial super apps are empowering users to manage their financial lives more efficiently.

FAQs

What are financial super apps?

Financial super apps are mobile applications that offer a wide range of financial services and products, such as banking, investing, insurance, and payments, all within a single platform. These apps aim to provide users with a one-stop solution for all their financial needs.

Why are financial super apps dominating Asian markets?

Financial super apps are dominating Asian markets due to their convenience and the wide range of services they offer. In many Asian countries, traditional banking and financial services may be less accessible, making super apps an attractive alternative. Additionally, the rise of digital payments and e-commerce in Asia has further fueled the popularity of these apps.

Which are the leading financial super apps in Asian markets?

Some of the leading financial super apps in Asian markets include Alipay and WeChat Pay in China, Grab and Gojek in Southeast Asia, and Paytm in India. These apps have gained significant market share and user adoption due to their comprehensive financial offerings and strong user engagement.

What are the benefits of using financial super apps?

Using financial super apps can offer several benefits, including convenience, access to a wide range of financial services, seamless integration with other digital platforms, and often lower fees compared to traditional financial institutions. These apps also often provide personalized recommendations and insights based on user behavior and transactions.

Are there any concerns or risks associated with financial super apps?

While financial super apps offer many benefits, there are also concerns about data privacy and security, as these apps often collect and store a large amount of user data. Additionally, the concentration of financial services within a few dominant super apps could potentially limit competition and consumer choice in the long run.