In recent years, Asia has witnessed a remarkable transformation in the financial services landscape, primarily driven by the emergence of financial super apps. These applications have revolutionized how individuals manage their finances, offering a one-stop solution for various financial needs. The rise of super apps can be attributed to several factors, including the rapid adoption of smartphones, increasing internet penetration, and a growing demand for seamless digital experiences.

Countries like China, India, and Southeast Asian nations have been at the forefront of this trend, with companies like WeChat, Grab, and Gojek leading the charge. The concept of a financial super app is not merely about providing a suite of services; it embodies a shift in consumer behavior and expectations. Users are increasingly seeking convenience and efficiency in managing their financial activities.

As a result, these apps have evolved from simple payment platforms to comprehensive ecosystems that encompass banking, investing, insurance, and more. The success of these super apps is also fueled by the younger demographic in Asia, who are more inclined to embrace digital solutions over traditional banking methods. This demographic shift has created fertile ground for innovation and competition among fintech companies.

Key Takeaways

- Financial super apps are on the rise in Asia, offering a wide range of financial services in one platform.

- These apps provide convenience and accessibility to users, allowing them to manage their banking, investing, and payment needs in one place.

- Technology plays a crucial role in driving the success of financial super apps, enabling seamless integration of various financial services.

- Traditional banking institutions are facing the impact of financial super apps, as they challenge the traditional banking model.

- Financial super apps are expanding into other services beyond finance, such as e-commerce and lifestyle offerings.

- Regulatory challenges are being faced by financial super apps as they navigate the complex regulatory landscape in Asia.

- The future of financial super apps in the Asian market looks promising, with continued expansion and innovation in the financial technology space.

The Convenience and Accessibility of Financial Super Apps

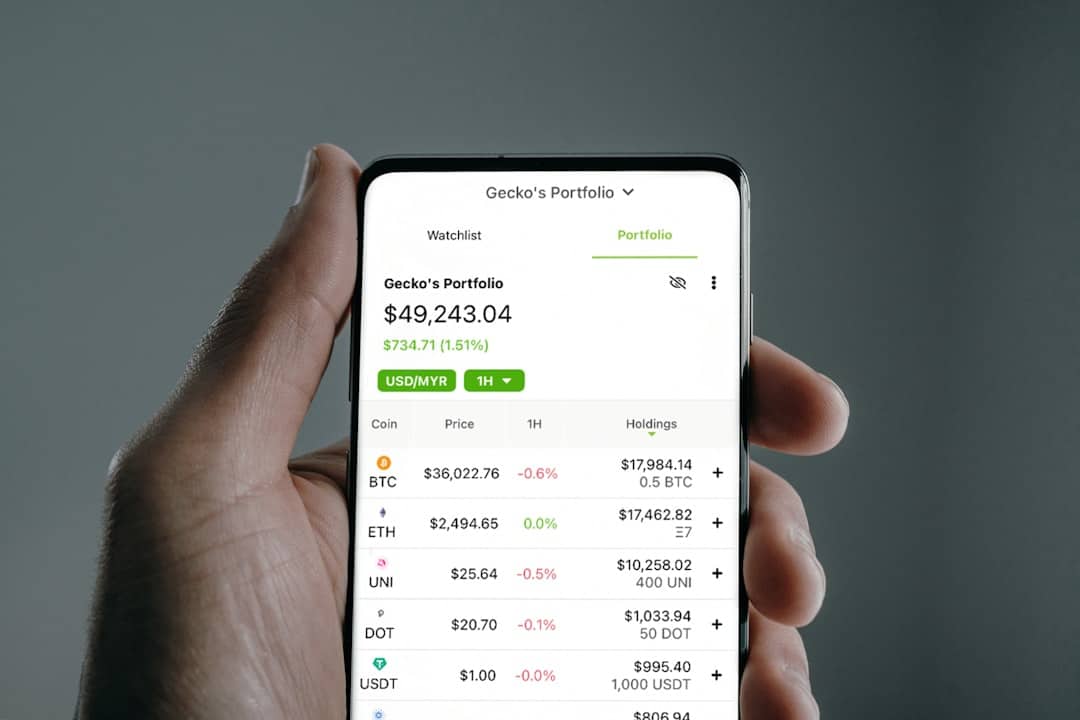

One of the most compelling features of financial super apps is their unparalleled convenience. Users can access a multitude of services from a single platform, eliminating the need to juggle multiple applications or visit physical bank branches. For instance, a user can transfer money, pay bills, invest in stocks, and even purchase insurance—all within the same app.

This level of integration not only saves time but also enhances the overall user experience.

Accessibility is another critical aspect that has contributed to the popularity of financial super apps.

In many Asian countries, traditional banking infrastructure is limited, particularly in rural areas. Super apps bridge this gap by providing financial services to underserved populations who may not have easy access to banks. For example, in Indonesia, where a significant portion of the population remains unbanked, platforms like Gojek have introduced digital wallets that allow users to make transactions without needing a bank account.

The Integration of Banking, Investing, and Payment Services

Financial super apps are characterized by their ability to integrate various financial services into a cohesive platform. This integration allows users to seamlessly transition between different financial activities without the friction typically associated with using multiple applications. For instance, a user can receive their salary directly into their digital wallet, use those funds to pay bills, and then invest any surplus in stocks or mutual funds—all within the same app.

This fluidity not only enhances user engagement but also encourages users to explore new financial products they might not have considered otherwise. Moreover, the integration of banking and investing services within super apps has led to innovative features that cater to diverse user needs. For example, some apps offer robo-advisory services that provide personalized investment recommendations based on users’ financial goals and risk tolerance.

This feature democratizes access to investment advice, which was traditionally reserved for wealthier individuals who could afford personal financial advisors. By making investing more accessible and user-friendly, super apps are fostering a culture of financial literacy and encouraging users to take charge of their financial futures.

The Role of Technology in Driving the Success of Financial Super Apps

The success of financial super apps is intricately linked to advancements in technology. The proliferation of smartphones and high-speed internet has created an environment conducive to the growth of digital financial services. Additionally, technologies such as artificial intelligence (AI), machine learning, and blockchain are playing pivotal roles in enhancing the functionality and security of these applications.

AI algorithms can analyze user behavior to provide personalized recommendations, while blockchain technology ensures secure transactions and data integrity. Furthermore, the use of APIs (Application Programming Interfaces) has enabled super apps to collaborate with various service providers seamlessly. This allows them to offer a wide range of services without having to develop every feature in-house.

For instance, a super app may partner with an insurance company to provide users with instant quotes for policies or collaborate with investment firms to offer trading capabilities. This modular approach not only accelerates innovation but also allows super apps to remain agile in responding to changing market demands.

The Impact of Financial Super Apps on Traditional Banking Institutions

The rise of financial super apps poses significant challenges to traditional banking institutions. As these apps gain traction among consumers, banks are increasingly finding themselves at risk of losing market share. The convenience and accessibility offered by super apps appeal particularly to younger consumers who prioritize digital experiences over traditional banking methods.

Consequently, banks must adapt their strategies to remain competitive in this evolving landscape. In response to this challenge, many traditional banks are beginning to embrace digital transformation initiatives. Some are developing their own super apps or partnering with fintech companies to enhance their service offerings.

For example, established banks in Asia are investing heavily in technology to create user-friendly mobile applications that incorporate features such as mobile payments and investment options. However, this transition is not without its difficulties; legacy systems often hinder banks’ ability to innovate quickly and respond effectively to consumer demands.

The Expansion of Financial Super Apps into Other Services

As financial super apps continue to evolve, many are expanding their offerings beyond traditional financial services into lifestyle and e-commerce sectors. This diversification strategy aims to create a comprehensive ecosystem that keeps users engaged within the app for various aspects of their lives. For instance, platforms like WeChat have integrated social media features alongside payment services, allowing users to chat with friends while making transactions or sharing experiences.

Additionally, some super apps are venturing into sectors such as travel booking, food delivery, and even health services. By providing these additional services, super apps can enhance user retention and increase transaction volumes within their platforms. For example, Grab has expanded from ride-hailing into food delivery and grocery shopping, creating a holistic platform that caters to users’ everyday needs.

This strategy not only strengthens customer loyalty but also positions these apps as indispensable tools in users’ daily lives.

The Regulatory Challenges Faced by Financial Super Apps

Despite their rapid growth and popularity, financial super apps face significant regulatory challenges that could impact their operations and expansion plans. As these platforms handle sensitive financial data and transactions, they must navigate complex regulatory environments that vary across different countries in Asia. Issues such as data privacy, anti-money laundering (AML) compliance, and consumer protection are paramount concerns for regulators.

In some cases, regulatory frameworks have struggled to keep pace with the rapid evolution of fintech innovations. For instance, while some countries have embraced open banking initiatives that encourage collaboration between banks and fintechs, others have imposed stringent regulations that may stifle innovation. Additionally, as super apps expand their service offerings into areas like insurance or investment management, they may face additional scrutiny from regulatory bodies that oversee these sectors.

Striking a balance between fostering innovation and ensuring consumer protection will be crucial for the sustainable growth of financial super apps.

The Future of Financial Super Apps in the Asian Market

Looking ahead, the future of financial super apps in the Asian market appears promising yet complex. As technology continues to advance and consumer preferences evolve, these platforms will need to adapt rapidly to maintain their competitive edge. The ongoing digital transformation across various sectors will likely drive further integration of services within super apps, creating even more comprehensive ecosystems for users.

Moreover, as competition intensifies among fintech companies and traditional banks alike, innovation will be key to differentiation. Super apps that can leverage emerging technologies such as AI-driven analytics or blockchain-based solutions will be better positioned to meet consumer demands for security and personalization. Additionally, as regulatory frameworks evolve to accommodate the unique challenges posed by super apps, companies that proactively engage with regulators will likely find themselves at an advantage.

In conclusion, while the rise of financial super apps presents numerous opportunities for growth and innovation in Asia’s financial landscape, it also brings challenges that require careful navigation. The interplay between technology advancements, regulatory developments, and changing consumer behaviors will shape the trajectory of these platforms in the coming years. As they continue to redefine how individuals interact with financial services, the potential for positive disruption remains significant.

In the rapidly evolving landscape of financial technology, the dominance of financial super apps in Asian markets is a testament to the region’s innovative approach to digital finance. These apps integrate a multitude of services, from banking to investment, under one platform, offering unparalleled convenience to users. A related article that explores the broader trends in digital platforms is Top Trends on Instagram 2023. This article delves into how social media platforms are evolving to meet user demands, similar to how financial super apps are reshaping the financial services industry in Asia. Both phenomena highlight the importance of adaptability and user-centric design in the digital age.

FAQs

What are financial super apps?

Financial super apps are mobile applications that offer a wide range of financial services and products, such as banking, investing, insurance, and payments, all within a single platform. These apps aim to provide users with a convenient and seamless way to manage their finances.

Why are financial super apps dominating Asian markets?

Financial super apps are dominating Asian markets due to several factors, including the widespread use of mobile technology, the convenience of accessing multiple financial services in one app, and the ability to cater to the diverse financial needs of a large and growing population.

Which companies are leading the financial super app trend in Asia?

Several companies are leading the financial super app trend in Asia, including Ant Group’s Alipay and Tencent’s WeChat Pay in China, Grab and Gojek in Southeast Asia, and Paytm in India. These companies have successfully integrated various financial services into their platforms, gaining a significant user base and market share.

What are the benefits of using financial super apps?

Using financial super apps offers several benefits, including convenience, cost-effectiveness, access to a wide range of financial services, personalized recommendations, and seamless integration with other everyday activities, such as shopping and transportation.

Are there any concerns or challenges associated with financial super apps?

Some concerns and challenges associated with financial super apps include data privacy and security issues, potential monopolistic practices by dominant players, regulatory compliance, and the risk of over-reliance on a single platform for various financial needs. Regulatory authorities are closely monitoring the growth of financial super apps to ensure consumer protection and fair competition.