Real-time data refers to information that is delivered immediately after collection, allowing for instantaneous analysis and decision-making. This type of data is crucial in various sectors, including finance, healthcare, and technology, as it provides a current snapshot of conditions and trends. In the financial realm, real-time data encompasses a wide array of information, such as stock prices, market trends, consumer spending patterns, and even social media sentiment.

The immediacy of this data enables financial professionals to respond swiftly to market changes, client needs, and emerging opportunities. The significance of real-time data lies in its ability to enhance decision-making processes. Unlike historical data, which can be outdated and less relevant, real-time data reflects the current state of affairs.

For instance, a financial advisor who has access to real-time market data can make informed recommendations to clients based on the latest trends rather than relying on past performance.

Key Takeaways

- Real-time data provides up-to-the-minute information on a client’s financial situation, allowing for more accurate and personalized coaching.

- Personalized financial coaching benefits from real-time data by enabling coaches to tailor their advice and strategies to each client’s specific needs and circumstances.

- Real-time data can be leveraged through various tools and technologies, such as budgeting apps and financial tracking software, to provide clients with a comprehensive view of their financial health.

- Implementing real-time data in financial coaching strategies requires a thorough understanding of the client’s financial goals, behaviors, and spending patterns.

- Real-time data, when combined with behavioral economics principles, can help financial coaches better understand and influence their clients’ financial decision-making processes.

The Importance of Real-Time Data in Personalized Financial Coaching

Personalized financial coaching hinges on the ability to tailor advice and strategies to individual client needs and circumstances. Real-time data plays a pivotal role in this personalization by providing insights that are specific to each client’s financial situation. For example, a coach can analyze a client’s spending habits in real time, identifying areas where they may be overspending or where they can save more effectively.

This level of detail allows for customized recommendations that resonate with the client’s unique financial landscape. Moreover, real-time data enhances the relevance of financial coaching by aligning advice with current market conditions. In an ever-changing economic environment, what worked yesterday may not be effective today.

By utilizing real-time data, financial coaches can ensure that their guidance is not only personalized but also timely. For instance, if a sudden market downturn occurs, a coach can quickly adjust their strategies to help clients mitigate losses or seize new investment opportunities. This adaptability is crucial in maintaining client trust and ensuring that they feel supported in their financial journeys.

Leveraging Real-Time Data for Personalized Financial Coaching

To effectively leverage real-time data in personalized financial coaching, coaches must first identify the key metrics that are most relevant to their clients. This could include tracking income fluctuations, monitoring expenses in various categories, or analyzing investment performance against market benchmarks. By focusing on these critical areas, coaches can provide insights that are not only actionable but also directly tied to the client’s financial goals.

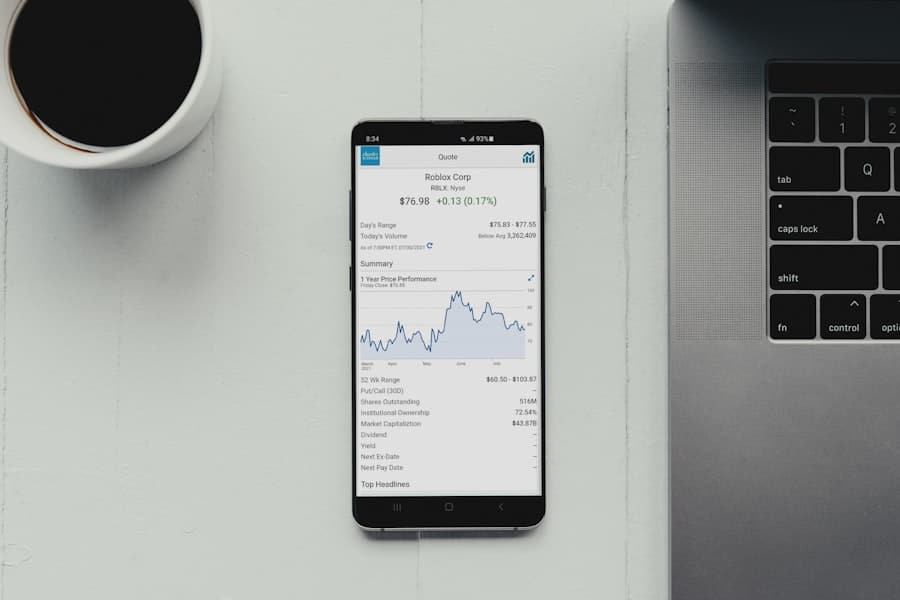

Additionally, integrating real-time data into coaching sessions can enhance client engagement. For instance, using interactive dashboards or mobile applications that display real-time financial metrics allows clients to visualize their progress and understand the implications of their financial decisions. This visual representation can lead to more meaningful discussions during coaching sessions, as clients can see firsthand how their actions impact their financial health.

By fostering this level of engagement, coaches can empower clients to take ownership of their financial decisions and encourage proactive behavior.

Implementing Real-Time Data in Financial Coaching Strategies

Implementing real-time data into financial coaching strategies requires a systematic approach that encompasses technology adoption, data integration, and continuous monitoring. Financial coaches must invest in tools that facilitate the collection and analysis of real-time data. This may involve utilizing software platforms that aggregate financial information from various sources, such as bank accounts, investment portfolios, and budgeting apps.

By centralizing this data, coaches can gain a comprehensive view of their clients’ financial situations. Once the necessary tools are in place, coaches should develop strategies for incorporating real-time data into their coaching sessions. This could involve setting specific goals based on current financial metrics or creating action plans that respond to real-time market changes.

For example, if a client’s investment portfolio is underperforming relative to market indices, the coach can use real-time data to recommend adjustments or diversification strategies that align with the client’s risk tolerance and long-term objectives. Continuous monitoring of these strategies ensures that they remain relevant and effective as market conditions evolve.

Real-Time Data Tools and Technologies for Financial Coaching

A variety of tools and technologies are available to facilitate the use of real-time data in financial coaching. Financial planning software such as eMoney Advisor or MoneyGuidePro offers features that allow coaches to track client progress in real time while providing insights into cash flow management and investment performance. These platforms often include visualization tools that help clients understand complex financial concepts through graphs and charts.

Additionally, mobile applications like Mint or YNAB (You Need A Budget) enable clients to monitor their spending habits in real time. These apps provide notifications about spending patterns and budget adherence, allowing coaches to address issues as they arise.

Real-Time Data and Behavioral Economics in Financial Coaching

Behavioral economics plays a significant role in understanding how individuals make financial decisions. Real-time data can be instrumental in addressing cognitive biases that often hinder effective decision-making. For instance, individuals may exhibit loss aversion—where they fear losses more than they value gains—leading them to make overly conservative investment choices.

By presenting real-time data that highlights potential gains alongside associated risks, coaches can help clients reframe their perspectives and make more balanced decisions. Moreover, real-time feedback can influence client behavior positively by reinforcing good habits or prompting corrective actions when necessary. For example, if a client receives immediate alerts about overspending in a particular category, they may be more inclined to adjust their behavior promptly rather than waiting until the end of the month when the damage is already done.

This immediate feedback loop aligns with principles from behavioral economics by promoting self-regulation and encouraging clients to take proactive steps toward achieving their financial goals.

Challenges and Considerations in Using Real-Time Data for Personalized Financial Coaching

While the benefits of using real-time data in personalized financial coaching are substantial, several challenges must be addressed to ensure effective implementation. One significant concern is data privacy and security. Financial coaches must navigate regulations such as GDPR or CCPA when handling sensitive client information.

Ensuring robust security measures are in place is essential to maintain client trust and comply with legal requirements. Another challenge lies in the potential for information overload. With an abundance of real-time data available, coaches must discern which metrics are most relevant for each client.

Providing too much information can overwhelm clients and lead to confusion rather than clarity. Therefore, it is crucial for coaches to curate the data they present and focus on key performance indicators that align with each client’s specific goals and circumstances.

The Future of Real-Time Data in Personalized Financial Coaching

The future of personalized financial coaching will likely see an increased reliance on advanced technologies such as artificial intelligence (AI) and machine learning (ML) to enhance the use of real-time data. These technologies can analyze vast amounts of data quickly and identify patterns that may not be immediately apparent to human analysts. As AI continues to evolve, it could provide even more tailored recommendations based on individual client behaviors and preferences.

Additionally, the integration of wearable technology may further revolutionize how real-time data is utilized in financial coaching. Devices that track spending habits or even biometric indicators related to stress levels could provide insights into how emotional states affect financial decision-making. This holistic approach could lead to more comprehensive coaching strategies that address both the emotional and rational aspects of personal finance.

As the landscape of personalized financial coaching continues to evolve with advancements in technology and an increasing emphasis on real-time data utilization, coaches who adapt to these changes will be better positioned to meet the needs of their clients effectively. The ongoing development of tools and methodologies will undoubtedly shape the future of financial coaching, making it more responsive, personalized, and impactful than ever before.

For more information on utilizing real-time data in financial coaching, check out this article on the best niches for affiliate marketing in Facebook. This article discusses how to leverage social media platforms like Facebook to reach a targeted audience and drive affiliate marketing success. By understanding the best niches to focus on, financial coaches can tailor their strategies to attract clients who are interested in personalized financial advice.

FAQs

What is real-time data in the context of personalized financial coaching?

Real-time data refers to the most current and up-to-date information about an individual’s financial situation, including income, expenses, savings, investments, and debts. This data is constantly updated and provides a real-time snapshot of a person’s financial health.

How is real-time data used in personalized financial coaching?

Real-time data is used in personalized financial coaching to provide accurate and timely insights into an individual’s financial habits, goals, and progress. Coaches can use this data to offer tailored advice, track progress, and make informed recommendations to help clients achieve their financial goals.

What are the benefits of using real-time data in personalized financial coaching?

Using real-time data in personalized financial coaching allows for more accurate and personalized guidance. It enables coaches to provide timely feedback, identify trends, and make adjustments to financial plans as needed. This can lead to more effective coaching and better outcomes for clients.

What are some examples of real-time data sources used in personalized financial coaching?

Real-time data sources used in personalized financial coaching may include bank account transactions, credit card statements, investment account balances, budgeting apps, and other financial tracking tools. These sources provide a comprehensive view of an individual’s financial situation in real time.

How does real-time data contribute to a more personalized approach to financial coaching?

Real-time data allows financial coaches to tailor their advice and recommendations based on a client’s current financial situation and behavior. This personalized approach can help clients make more informed decisions, stay on track with their financial goals, and ultimately achieve greater financial success.