In recent years, the banking landscape has undergone a significant transformation, primarily driven by technological advancements and changing consumer preferences. Mobile-only banks, also known as digital banks or neobanks, have emerged as a revolutionary force in the financial sector. These institutions operate exclusively through mobile applications and online platforms, eliminating the need for physical branches.

This shift has not only made banking more accessible but has also introduced a new paradigm in how financial services are delivered. With the proliferation of smartphones and internet connectivity, mobile-only banks are poised to cater to a diverse range of customers, particularly those in underserved regions. The rise of mobile-only banks is particularly relevant in the context of financial inclusion.

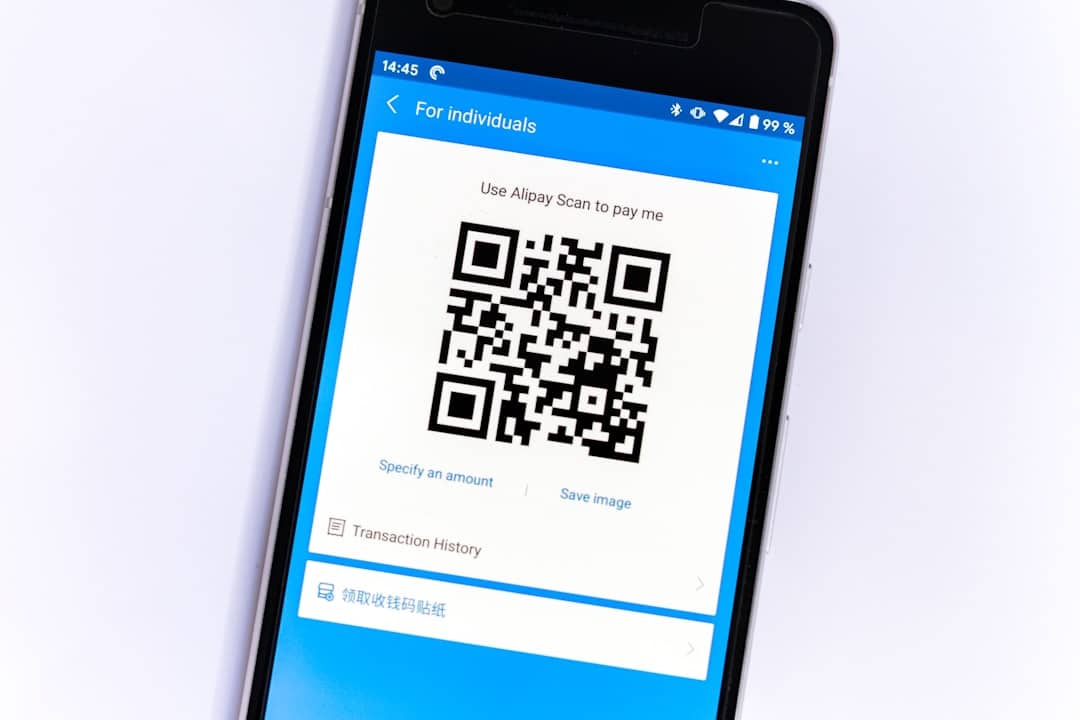

Traditional banking systems often struggle to reach rural and remote areas, where access to physical branches is limited. Mobile-only banks leverage technology to provide essential financial services such as savings accounts, loans, and payment solutions directly to consumers’ smartphones. This innovation has the potential to bridge the gap between the unbanked population and formal financial systems, fostering economic growth and stability in communities that have historically been marginalized by conventional banking practices.

Key Takeaways

- Mobile-only banks are financial institutions that operate exclusively through mobile apps, providing banking services without physical branches.

- Challenges of financial inclusion in rural areas include limited access to traditional banking services, lack of infrastructure, and low levels of financial literacy.

- Mobile-only banks have a significant impact on rural communities by providing access to basic banking services, enabling financial transactions, and promoting economic growth.

- Technology plays a crucial role in bridging the gap in rural financial inclusion by providing secure and convenient banking services through mobile devices.

- Case studies of successful mobile-only banks in rural areas demonstrate the potential for these institutions to drive financial inclusion, empower communities, and stimulate economic development.

Challenges of Financial Inclusion in Rural Areas

Barriers to Accessing Financial Services

The absence of physical bank branches means that residents often have to travel long distances to access financial services, which can be both time-consuming and costly.

Cultural and Economic Factors

Cultural factors and economic conditions further exacerbate the issue of financial exclusion in rural communities. Many individuals may not have the necessary identification documents required to open a bank account, while others may be hesitant to engage with formal financial systems due to past negative experiences or a lack of understanding of banking products.

The Cycle of Exclusion

Additionally, low levels of income and high rates of unemployment can deter individuals from seeking out banking services, as they may perceive them as unnecessary or unattainable. These challenges create a cycle of exclusion that is difficult to break without targeted interventions.

The Impact of Mobile-Only Banks on Rural Communities

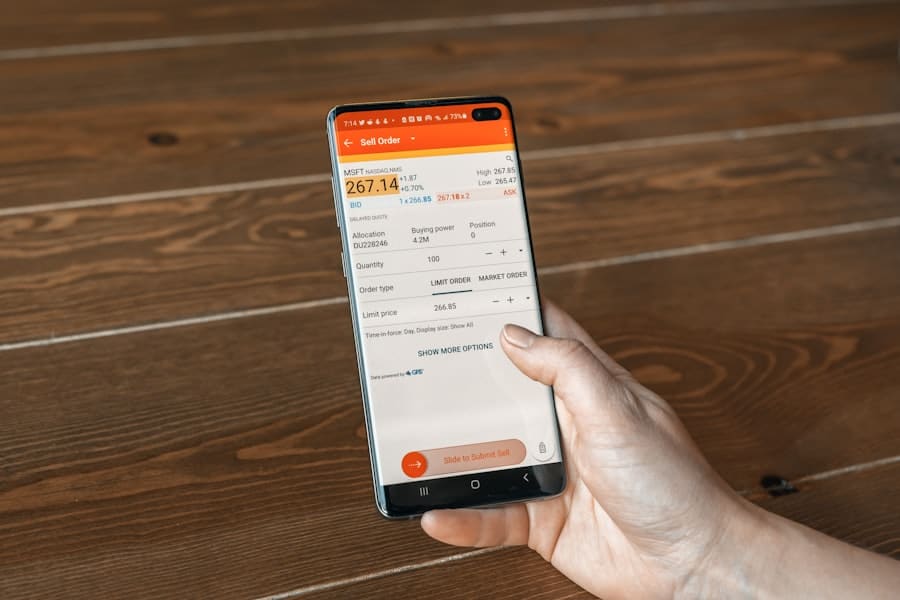

Mobile-only banks have the potential to significantly impact rural communities by providing them with access to essential financial services that were previously out of reach. By offering banking solutions through mobile applications, these institutions can eliminate geographical barriers and empower individuals to manage their finances more effectively. For instance, farmers can access loans for equipment or seeds directly from their smartphones, enabling them to invest in their businesses without the need for lengthy trips to distant banks.

Furthermore, mobile-only banks often provide lower fees and more competitive interest rates compared to traditional banks, making financial services more affordable for rural residents. This affordability can encourage savings and investment, fostering economic development within these communities. Additionally, mobile-only banks frequently offer user-friendly interfaces and educational resources that help customers understand financial products better, thereby promoting financial literacy and responsible money management.

The convenience of mobile banking also allows for real-time transactions and instant access to funds, which can be particularly beneficial in emergencies. For example, if a family faces an unexpected medical expense, they can quickly transfer money or apply for a small loan through their mobile banking app without the delays associated with traditional banking processes. This immediacy can enhance the overall resilience of rural households and contribute to improved quality of life.

The Role of Technology in Bridging the Gap

Technology plays a pivotal role in bridging the gap between unbanked populations and formal financial systems. Mobile-only banks utilize advanced technologies such as artificial intelligence (AI), machine learning, and big data analytics to tailor their services to meet the unique needs of rural customers. By analyzing user behavior and transaction patterns, these banks can offer personalized financial products that align with individual circumstances and preferences.

Moreover, the integration of biometric authentication methods—such as fingerprint scanning or facial recognition—enhances security while simplifying the account opening process for users who may lack traditional identification documents. This technological innovation not only fosters trust among potential customers but also streamlines onboarding processes, making it easier for individuals in rural areas to access banking services. Additionally, mobile-only banks often collaborate with local businesses and community organizations to promote their services and educate potential customers about the benefits of digital banking.

By leveraging existing community networks, these banks can build trust and credibility while ensuring that their offerings are relevant and accessible. This collaborative approach is essential for overcoming skepticism and encouraging adoption among populations that may be wary of new technologies.

Case Studies of Successful Mobile-Only Banks in Rural Areas

Several mobile-only banks have successfully penetrated rural markets, demonstrating the viability of this model in promoting financial inclusion. One notable example is M-Pesa in Kenya, which has transformed the way individuals in rural areas conduct financial transactions. Launched in 2007 by Safaricom, M-Pesa allows users to send money, pay bills, and access microloans through their mobile phones without needing a traditional bank account.

M-Pesa’s success can be attributed to its user-friendly interface and extensive agent network that facilitates cash-in and cash-out transactions. By partnering with local merchants and community members, M-Pesa has created a robust ecosystem that supports financial transactions while fostering trust among users.

As a result, millions of Kenyans have gained access to financial services that were previously unavailable to them. Another compelling case study is India’s Paytm Payments Bank, which aims to provide comprehensive banking solutions through its mobile platform. Launched in 2016, Paytm Payments Bank offers savings accounts, digital wallets, and payment services tailored for underserved populations.

The bank has made significant strides in reaching rural customers by leveraging its extensive network of agents and partnerships with local businesses. By focusing on customer education and providing incentives for using digital banking services, Paytm has successfully onboarded millions of users from rural areas.

The Importance of Financial Literacy and Education

While mobile-only banks offer innovative solutions for financial inclusion, the success of these initiatives hinges on the financial literacy of their target populations. Many individuals in rural areas may lack basic knowledge about banking products, savings strategies, or investment opportunities. Therefore, it is crucial for mobile-only banks to prioritize financial education as part of their service offerings.

Educational programs can take various forms, including workshops, online tutorials, or interactive features within mobile applications that guide users through different financial concepts. For instance, a mobile-only bank might incorporate gamified learning experiences that allow users to practice budgeting or saving techniques in a risk-free environment. By making financial education engaging and accessible, these institutions can empower individuals to make informed decisions about their finances.

Moreover, fostering a culture of financial literacy can have far-reaching implications for entire communities. As individuals become more knowledgeable about managing their finances, they are likely to share this information with family members and friends, creating a ripple effect that enhances overall community well-being. This collective improvement in financial literacy can lead to increased savings rates, better investment decisions, and ultimately contribute to economic growth within rural areas.

Regulatory and Policy Considerations for Mobile-Only Banks

The rapid growth of mobile-only banks raises important regulatory and policy considerations that must be addressed to ensure consumer protection and promote sustainable practices within the industry. Regulators must strike a balance between fostering innovation and safeguarding the interests of consumers who may be vulnerable due to their lack of experience with digital banking. One key area of focus is data privacy and security.

As mobile-only banks collect vast amounts of personal information from their users, it is imperative that they implement robust security measures to protect this data from breaches or misuse. Regulatory frameworks should establish clear guidelines regarding data handling practices while ensuring that consumers are informed about how their information will be used. Additionally, regulators must consider the unique challenges faced by mobile-only banks operating in rural areas.

For instance, policies should encourage collaboration between traditional banks and digital institutions to expand access to underserved populations while maintaining fair competition within the market. Furthermore, regulatory bodies should support initiatives aimed at enhancing digital infrastructure in rural regions to facilitate seamless access to mobile banking services.

The Future of Mobile-Only Banks in Rural Financial Inclusion

The future of mobile-only banks appears promising as they continue to evolve and adapt to the needs of underserved populations in rural areas. As technology advances further—encompassing innovations such as blockchain and artificial intelligence—the potential for these institutions to enhance financial inclusion will only grow stronger. The ability to offer tailored products based on real-time data analysis will enable mobile-only banks to serve diverse customer segments more effectively.

Moreover, as awareness of digital banking increases among rural populations, more individuals are likely to embrace these services as viable alternatives to traditional banking methods. The ongoing efforts by governments and organizations worldwide to improve digital literacy will further facilitate this transition by equipping individuals with the skills needed to navigate mobile banking platforms confidently. In conclusion, mobile-only banks represent a transformative force in promoting financial inclusion within rural communities.

By leveraging technology and prioritizing customer education, these institutions can empower individuals who have historically been excluded from formal financial systems. As they continue to innovate and adapt to changing market dynamics, mobile-only banks will play an increasingly vital role in shaping the future of finance for underserved populations around the globe.