The financial sector has undergone a significant transformation in recent years, driven by rapid advancements in technology. Among these advancements, artificial intelligence (AI) stands out as a powerful tool that has the potential to reshape the landscape of financial services. AI encompasses a range of technologies, including machine learning, natural language processing, and data analytics, which can be harnessed to improve efficiency, enhance decision-making, and mitigate risks.

However, as financial institutions increasingly adopt AI solutions, the importance of ethical compliance becomes paramount. Ethical compliance refers to the adherence to laws, regulations, and ethical standards that govern financial practices. The intersection of AI and ethical compliance presents both opportunities and challenges that must be navigated carefully.

The integration of AI into finance raises critical questions about accountability, transparency, and fairness. Financial institutions are tasked with not only leveraging AI to drive profitability but also ensuring that their practices align with ethical standards and regulatory requirements.

This article delves into the current challenges faced by the finance industry regarding ethical compliance, explores how AI can enhance these efforts, and examines the implications of AI on ethical practices within the sector.

Key Takeaways

- Introduction to AI and Ethical Compliance in Finance:

- AI is revolutionizing the finance industry, but ethical compliance is a key concern.

- The Current Challenges in Ethical Compliance in Finance:

- Complex regulations, evolving risks, and human error make ethical compliance challenging in finance.

- How AI Can Enhance Ethical Compliance in Finance:

- AI can automate compliance processes, analyze large datasets, and identify potential risks more efficiently.

- The Role of AI in Detecting and Preventing Financial Fraud:

- AI can detect patterns, anomalies, and potential fraud in real-time, enhancing fraud prevention in finance.

- Using AI for Monitoring and Reporting Ethical Compliance:

- AI can monitor transactions, analyze behavior, and generate accurate compliance reports in finance.

The Current Challenges in Ethical Compliance in Finance

Complex Regulatory Frameworks

One of the most pressing issues is the complexity of regulatory frameworks that govern financial practices. Financial institutions must navigate a labyrinth of local, national, and international regulations, which can vary significantly across jurisdictions. This complexity often leads to confusion and inconsistency in compliance efforts.

The Rise of Financial Fraud and Misconduct

Moreover, the rapid pace of technological innovation means that regulations frequently lag behind emerging practices, creating a gap that can be exploited by unethical actors. Another significant challenge is the prevalence of financial fraud and misconduct. High-profile scandals have eroded public trust in financial institutions, highlighting the need for robust ethical compliance mechanisms. Instances of insider trading, money laundering, and market manipulation have underscored the vulnerabilities within the system.

New Risks in Digital Currencies and DeFi

Additionally, the rise of digital currencies and decentralized finance (DeFi) has introduced new risks that traditional compliance frameworks may not adequately address. As financial institutions strive to maintain their reputations and adhere to ethical standards, they must confront these challenges head-on.

How AI Can Enhance Ethical Compliance in Finance

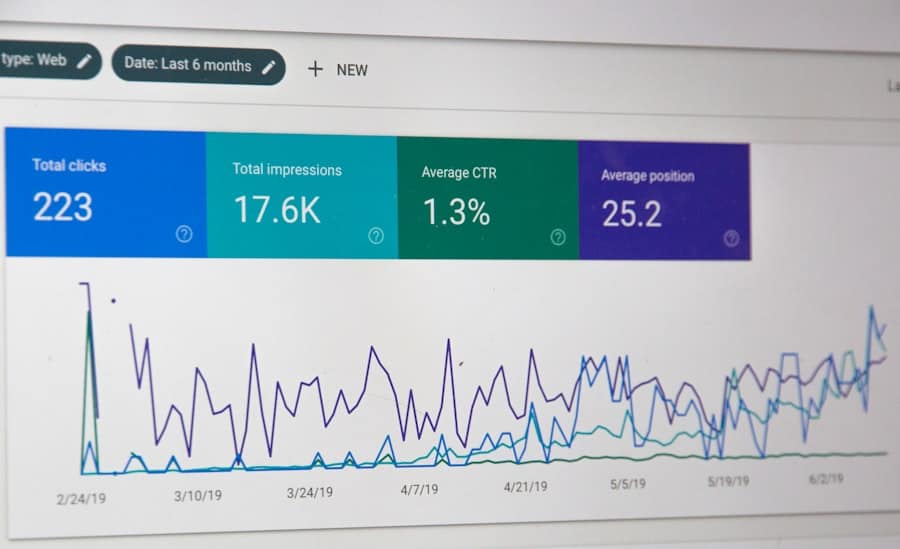

AI has the potential to revolutionize ethical compliance in finance by providing tools that enhance monitoring, reporting, and decision-making processes. One of the primary ways AI can contribute is through advanced data analytics. By analyzing vast amounts of data in real-time, AI systems can identify patterns and anomalies that may indicate unethical behavior or compliance breaches.

For instance, machine learning algorithms can be trained to detect unusual trading patterns that could signal insider trading or market manipulation. This proactive approach allows financial institutions to address potential issues before they escalate into significant problems. Furthermore, AI can streamline compliance processes by automating routine tasks such as data collection and reporting.

Traditional compliance efforts often involve manual processes that are time-consuming and prone to human error. By leveraging AI-driven automation, financial institutions can reduce the burden on compliance teams and ensure more accurate reporting. For example, natural language processing can be used to analyze regulatory documents and extract relevant information, enabling institutions to stay up-to-date with changing regulations without overwhelming their staff.

The Role of AI in Detecting and Preventing Financial Fraud

Financial fraud remains a pervasive issue that poses significant risks to both institutions and consumers. AI plays a crucial role in detecting and preventing such fraudulent activities through sophisticated algorithms that analyze transaction data for signs of irregularities. For instance, credit card companies utilize machine learning models to assess transaction patterns in real-time.

When a transaction deviates from established norms—such as an unusually large purchase in a foreign country—AI systems can flag it for further investigation or automatically decline it until verification is obtained. Moreover, AI’s ability to learn from historical data enhances its effectiveness in fraud detection. By continuously updating its models based on new data inputs, AI systems can adapt to evolving fraud tactics employed by criminals.

This dynamic learning process allows financial institutions to stay one step ahead of fraudsters. Additionally, AI can facilitate collaboration among institutions by sharing insights and patterns related to fraudulent activities across networks, thereby strengthening collective defenses against financial crime.

Using AI for Monitoring and Reporting Ethical Compliance

Monitoring and reporting are critical components of ethical compliance in finance. AI technologies can significantly enhance these processes by providing real-time insights into compliance status and potential risks. For example, AI-driven dashboards can aggregate data from various sources—such as transaction records, employee behavior, and regulatory changes—to provide a comprehensive view of an institution’s compliance landscape.

This holistic approach enables compliance officers to identify areas of concern quickly and allocate resources effectively. In addition to monitoring, AI can improve reporting accuracy by automating the generation of compliance reports. Traditional reporting methods often involve manual data entry and reconciliation, which can lead to errors and inconsistencies.

By automating these processes through AI algorithms, financial institutions can ensure that their reports are not only accurate but also timely. This capability is particularly important in an environment where regulatory requirements are constantly evolving, as it allows institutions to adapt their reporting practices swiftly in response to new mandates.

The Ethical Implications of AI in Finance

While AI offers numerous benefits for enhancing ethical compliance in finance, it also raises important ethical considerations that must be addressed. One major concern is the potential for bias in AI algorithms. If the data used to train these systems contains biases—whether intentional or unintentional—there is a risk that the resulting models will perpetuate or even exacerbate existing inequalities.

For instance, biased algorithms could lead to discriminatory lending practices or unfair treatment of certain customer segments. Financial institutions must prioritize fairness and transparency in their AI initiatives to mitigate these risks. Another ethical implication involves accountability for decisions made by AI systems.

As financial institutions increasingly rely on automated processes for compliance monitoring and decision-making, questions arise regarding who is responsible when an AI system makes an erroneous judgment or fails to detect a compliance breach. Establishing clear lines of accountability is essential to ensure that ethical standards are upheld and that stakeholders can trust the decisions made by these systems.

Implementing AI Solutions for Ethical Compliance in Finance

The successful implementation of AI solutions for ethical compliance requires careful planning and consideration of various factors. First and foremost, financial institutions must invest in high-quality data management practices. The effectiveness of AI algorithms hinges on the quality of the data they are trained on; therefore, ensuring accurate, complete, and unbiased data is crucial for achieving reliable outcomes.

Institutions should establish robust data governance frameworks that prioritize data integrity while addressing privacy concerns. Training employees on the use of AI tools is another critical aspect of implementation. While technology can enhance compliance efforts significantly, human oversight remains essential.

Employees must understand how to interpret AI-generated insights and make informed decisions based on those findings. Additionally, fostering a culture of continuous learning will enable staff to adapt to evolving technologies and regulatory landscapes effectively.

The Future of AI and Ethical Compliance in Finance

Looking ahead, the future of AI in ethical compliance within finance appears promising yet complex. As technology continues to evolve at an unprecedented pace, financial institutions will need to remain agile in their approach to compliance challenges. The integration of advanced technologies such as blockchain alongside AI could further enhance transparency and accountability within financial transactions.

Blockchain’s immutable ledger could serve as a reliable source of truth for compliance audits while providing an additional layer of security against fraud. Moreover, as regulatory bodies become more attuned to the implications of AI in finance, we may see the emergence of new guidelines specifically addressing ethical considerations related to technology use. Financial institutions will need to proactively engage with regulators to shape these frameworks while ensuring their own practices align with emerging standards.

In conclusion, while the journey toward integrating AI into ethical compliance in finance is fraught with challenges, it also presents significant opportunities for innovation and improvement. By leveraging AI’s capabilities responsibly and ethically, financial institutions can enhance their compliance efforts while rebuilding trust with stakeholders in an increasingly complex landscape.

In a recent article on how one founder realized the potential of sustainable energy, the importance of ethical decision-making and compliance in the finance industry is further emphasized. Just as AI can enhance ethical compliance in finance, sustainable energy practices require a commitment to ethical and responsible behavior. Both areas highlight the need for transparency, accountability, and integrity in order to create a more sustainable and ethical future for all.

FAQs

What is the role of AI in enhancing ethical compliance in finance?

AI plays a crucial role in enhancing ethical compliance in finance by automating processes, detecting potential ethical violations, and analyzing large volumes of data to identify patterns and trends that may indicate unethical behavior.

How does AI help in automating compliance processes in finance?

AI helps in automating compliance processes in finance by using algorithms to review and analyze large volumes of data, identify potential compliance issues, and generate reports, thus reducing the need for manual intervention and minimizing the risk of human error.

What are the benefits of using AI for ethical compliance in finance?

The benefits of using AI for ethical compliance in finance include improved accuracy and efficiency in detecting potential ethical violations, enhanced monitoring of transactions and activities, and the ability to adapt to evolving regulatory requirements and industry standards.

How does AI assist in detecting potential ethical violations in finance?

AI assists in detecting potential ethical violations in finance by using machine learning algorithms to analyze data and identify patterns or anomalies that may indicate unethical behavior, such as fraud, money laundering, or insider trading.

What are the challenges associated with using AI for ethical compliance in finance?

Challenges associated with using AI for ethical compliance in finance include the need for high-quality data, the potential for algorithmic bias, and the requirement for ongoing monitoring and oversight to ensure the accuracy and fairness of AI-driven compliance processes.