Anomaly detection is a critical component of financial systems, serving as a safeguard against irregularities that could indicate fraud, operational errors, or systemic failures. In the complex and fast-paced world of finance, where vast amounts of data are generated every second, the ability to identify deviations from expected patterns is paramount. Anomalies can manifest in various forms, such as unusual transaction amounts, unexpected trading volumes, or atypical customer behavior.

The consequences of failing to detect these anomalies can be severe, ranging from financial losses to reputational damage and regulatory penalties. The traditional methods of anomaly detection often rely on statistical techniques and rule-based systems, which can be limited in their effectiveness due to the dynamic nature of financial markets. As financial transactions become increasingly sophisticated and the volume of data continues to grow exponentially, there is a pressing need for more advanced solutions.

This is where artificial intelligence (AI) comes into play, offering innovative approaches that enhance the accuracy and efficiency of anomaly detection processes. By leveraging machine learning algorithms and advanced data analytics, AI can sift through vast datasets to identify subtle patterns and anomalies that may go unnoticed by human analysts or conventional systems.

Key Takeaways

- Anomaly detection is crucial in finance systems to identify irregularities and potential fraud.

- AI is needed in anomaly detection to handle the large volume and complexity of financial data.

- AI is used in anomaly detection through machine learning algorithms and pattern recognition.

- Advantages of using AI for anomaly detection include faster detection, reduced false positives, and scalability.

- Challenges of AI in anomaly detection include data quality, interpretability, and the need for continuous learning and adaptation.

The Need for AI in Anomaly Detection

The Limitations of Traditional Anomaly Detection

Traditional rule-based systems often flag legitimate transactions as suspicious simply because they fall outside predefined parameters. This not only wastes valuable resources but can also cause unnecessary delays or account freezes for customers.

The Need for AI in Anomaly Detection

The need for AI in anomaly detection arises from the necessity to improve accuracy while minimizing operational disruptions. The evolving landscape of financial crime necessitates a more agile approach to anomaly detection, as cybercriminals constantly develop new tactics to exploit vulnerabilities in financial systems.

Enhancing Anomaly Detection with AI

By integrating AI into anomaly detection frameworks, financial institutions can enhance their ability to respond to threats in real-time. AI can analyze historical data to identify emerging trends and adapt its detection algorithms accordingly, making it crucial in a world where fraud schemes are becoming increasingly sophisticated. This enables financial institutions to safeguard their assets and maintain customer trust.

How AI is Used in Anomaly Detection

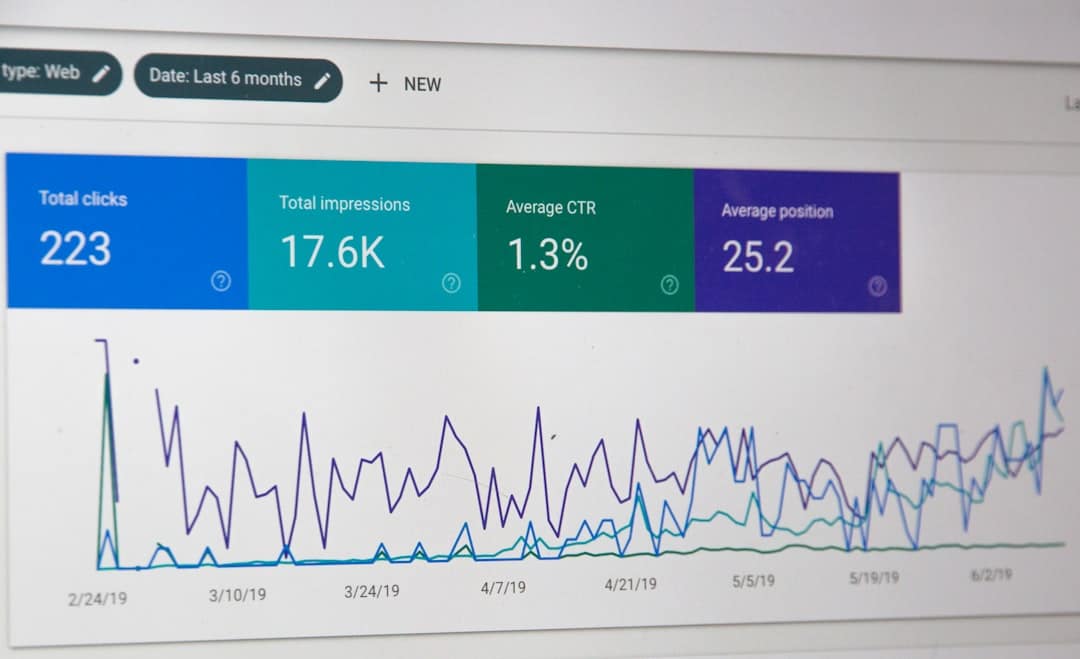

AI employs various techniques to enhance anomaly detection in finance systems, with machine learning being one of the most prominent methods. Machine learning algorithms can be trained on historical transaction data to recognize normal behavior patterns within a specific context. Once trained, these algorithms can then analyze new transactions in real-time, flagging those that deviate significantly from established norms.

For example, if a customer typically makes small purchases but suddenly attempts a large withdrawal, the system can automatically raise an alert for further investigation. Another approach involves the use of unsupervised learning techniques, which do not require labeled data for training. These algorithms can identify anomalies based solely on the inherent structure of the data.

Clustering methods, for instance, group similar transactions together and highlight those that fall outside these clusters as potential anomalies. This is particularly useful in scenarios where historical data may be limited or where new types of transactions are being introduced. By utilizing unsupervised learning, financial institutions can remain agile and responsive to new patterns of behavior without relying solely on historical precedents.

Advantages of Using AI for Anomaly Detection

The integration of AI into anomaly detection processes offers several significant advantages over traditional methods. One of the most notable benefits is the ability to process vast amounts of data at unprecedented speeds. AI algorithms can analyze millions of transactions in real-time, identifying anomalies that would be impossible for human analysts to detect manually.

This rapid processing capability not only enhances the efficiency of anomaly detection but also allows organizations to respond swiftly to potential threats. Additionally, AI-driven anomaly detection systems can continuously learn and improve over time. As they are exposed to new data and feedback from human analysts, these systems refine their algorithms to reduce false positives and increase detection accuracy.

This self-improving capability is particularly valuable in the finance sector, where patterns of behavior can change rapidly due to market fluctuations or shifts in consumer behavior. By leveraging AI’s adaptability, financial institutions can maintain robust defenses against emerging threats while minimizing operational disruptions caused by false alarms.

Challenges and Limitations of AI in Anomaly Detection

Despite its many advantages, the implementation of AI in anomaly detection is not without challenges.

Incomplete or biased datasets can lead to inaccurate predictions and missed detections.

For instance, if a model is trained primarily on data from a specific demographic or geographic region, it may struggle to accurately identify anomalies in transactions from other groups. Ensuring that training datasets are representative and comprehensive is crucial for the effectiveness of AI-driven anomaly detection systems. Another challenge lies in the interpretability of AI models.

Many machine learning algorithms operate as “black boxes,” making it difficult for analysts to understand how decisions are made. This lack of transparency can hinder trust in the system and complicate compliance with regulatory requirements that demand clear explanations for flagged transactions. Financial institutions must strike a balance between leveraging advanced AI techniques and ensuring that their systems remain interpretable and accountable.

Best Practices for Implementing AI in Anomaly Detection

To maximize the effectiveness of AI in anomaly detection, financial institutions should adhere to several best practices during implementation. First and foremost, organizations should invest in high-quality data collection and management practices. This includes ensuring that data is accurate, complete, and representative of the diverse range of transactions processed by the institution.

Regular audits and updates to datasets can help maintain their relevance and reliability. Additionally, organizations should prioritize collaboration between data scientists and domain experts during the development of anomaly detection models. While data scientists possess technical expertise in machine learning, domain experts bring invaluable insights into industry-specific behaviors and trends.

By working together, these teams can create models that are not only technically sound but also aligned with the unique characteristics of the financial environment. Furthermore, continuous monitoring and evaluation of AI models are essential for maintaining their effectiveness over time. Financial institutions should establish feedback loops that allow human analysts to review flagged transactions and provide input on model performance.

This iterative process enables organizations to refine their algorithms based on real-world outcomes and adapt to changing patterns of behavior.

Case Studies of Successful AI Anomaly Detection in Finance Systems

Several financial institutions have successfully implemented AI-driven anomaly detection systems, showcasing the technology’s potential to enhance security and operational efficiency. One notable example is JPMorgan Chase, which has integrated machine learning algorithms into its fraud detection processes. By analyzing transaction patterns across millions of accounts, the bank has significantly reduced false positives while improving its ability to identify fraudulent activities in real-time.

Another case study involves PayPal, which employs AI to monitor transactions for signs of fraud or unusual behavior. The company utilizes a combination of supervised and unsupervised learning techniques to analyze user behavior across its platform. This approach has enabled PayPal to detect anomalies with greater accuracy while minimizing disruptions for legitimate users.

As a result, PayPal has been able to maintain customer trust while effectively combating fraud. These case studies illustrate how AI can transform anomaly detection processes within financial systems, leading to improved security measures and enhanced customer experiences.

Future Trends and Developments in AI Anomaly Detection

The future of AI in anomaly detection within finance systems is poised for significant advancements as technology continues to evolve. One emerging trend is the increased use of explainable AI (XAI) techniques that aim to enhance transparency in machine learning models. As regulatory scrutiny intensifies around algorithmic decision-making, financial institutions will likely prioritize XAI solutions that provide clear insights into how anomalies are detected and flagged.

Additionally, the integration of natural language processing (NLP) into anomaly detection systems may become more prevalent.

This holistic approach could provide financial institutions with a more comprehensive view of potential anomalies.

Finally, as cyber threats continue to evolve, there will be an increasing emphasis on developing adaptive AI systems capable of responding dynamically to new types of fraud schemes. These systems will leverage real-time data feeds and advanced analytics to continuously refine their detection capabilities, ensuring that financial institutions remain one step ahead of potential threats. In conclusion, the integration of AI into anomaly detection processes within finance systems represents a transformative shift that enhances security measures while improving operational efficiency.

As technology continues to advance, organizations must remain vigilant in adapting their strategies to leverage these innovations effectively.

In a recent article on the best software for social media management in 2023, the importance of utilizing advanced technology to streamline processes and improve efficiency is highlighted. This resonates with the discussion on the role of AI in anomaly detection across finance systems, as both topics emphasize the benefits of leveraging cutting-edge tools to enhance performance and decision-making. By incorporating AI into financial systems, organizations can better detect irregularities and potential risks, ultimately leading to more secure and reliable operations.

FAQs

What is anomaly detection in finance systems?

Anomaly detection in finance systems refers to the process of identifying unusual patterns or outliers in financial data that deviate from the norm. These anomalies could indicate potential fraud, errors, or other irregularities that require further investigation.

How does AI contribute to anomaly detection in finance systems?

AI plays a crucial role in anomaly detection in finance systems by leveraging machine learning algorithms to analyze large volumes of financial data and identify patterns that may indicate anomalies. AI can automate the detection process, making it more efficient and effective than traditional manual methods.

What are the benefits of using AI for anomaly detection in finance systems?

Using AI for anomaly detection in finance systems can lead to faster and more accurate identification of potential issues, reducing the risk of financial losses due to fraud or errors. AI can also adapt to evolving patterns and trends in financial data, improving the overall effectiveness of anomaly detection.

What are some common techniques used in AI-based anomaly detection for finance systems?

Common techniques used in AI-based anomaly detection for finance systems include supervised learning, unsupervised learning, and reinforcement learning. These techniques enable AI systems to learn from historical data and identify anomalies based on predefined criteria or by detecting deviations from normal patterns.

What are the challenges of implementing AI for anomaly detection in finance systems?

Challenges of implementing AI for anomaly detection in finance systems include the need for high-quality, labeled training data, ensuring the transparency and interpretability of AI models, and addressing potential biases in the data that could impact the accuracy of anomaly detection. Additionally, regulatory and compliance considerations must be taken into account when implementing AI in finance systems.