In recent years, the financial landscape has undergone a significant transformation, largely driven by advancements in technology. Among these innovations, artificial intelligence (AI) has emerged as a powerful tool that is reshaping how individuals manage their finances. AI-powered financial planning apps are at the forefront of this revolution, offering users sophisticated tools that leverage machine learning algorithms and data analytics to provide personalized financial advice and insights.

These applications are designed to help users navigate complex financial decisions, from budgeting and saving to investing and retirement planning. The rise of AI in financial planning is not merely a trend; it reflects a broader shift towards digitalization in the financial services industry. As consumers increasingly seek convenience and efficiency, financial institutions and tech companies have responded by developing apps that harness the power of AI to deliver tailored solutions.

This evolution is particularly significant in a world where traditional financial advice can often be inaccessible or overly generalized. By utilizing AI, these apps can analyze vast amounts of data to offer insights that are specifically relevant to individual users, thereby democratizing access to financial planning resources.

Key Takeaways

- AI-powered financial planning apps use artificial intelligence to provide personalized financial advice and assistance to users.

- Current AI-powered financial planning apps offer features such as automated budgeting, investment recommendations, and expense tracking.

- Advantages of AI-powered financial planning apps include convenience, accessibility, and the ability to analyze large amounts of data for personalized recommendations.

- Challenges and limitations of AI-powered financial planning apps include potential biases in algorithms, data privacy concerns, and the need for human oversight.

- AI plays a crucial role in providing personalized financial advice by analyzing user data and behavior to offer tailored recommendations and insights.

- AI-powered financial planning apps are disrupting traditional financial services by offering more accessible and affordable financial advice to a wider audience.

- Ethical and privacy considerations in AI-powered financial planning apps include the responsible use of user data and ensuring transparency in algorithmic decision-making.

- The future of AI-powered financial planning apps is expected to include advancements in natural language processing, increased personalization, and improved data security measures.

Current State of AI-Powered Financial Planning Apps

As of 2023, the market for AI-powered financial planning apps is burgeoning, with numerous platforms available to consumers. These apps range from comprehensive financial management tools that encompass budgeting, investment tracking, and retirement planning to specialized applications focused on specific aspects of personal finance. Notable examples include platforms like Mint, which offers budgeting tools and expense tracking, and Betterment, which provides automated investment management services.

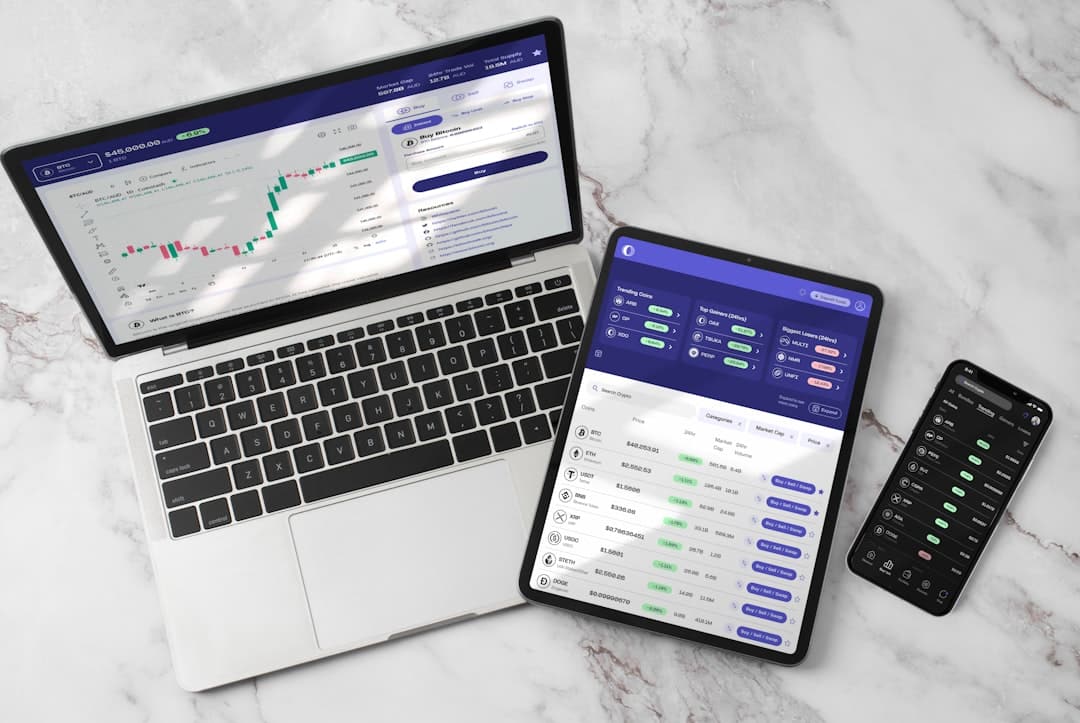

Each of these applications employs AI algorithms to enhance user experience and deliver actionable insights. The current state of these apps is characterized by a growing emphasis on user-friendly interfaces and seamless integration with various financial accounts. Many AI-powered financial planning apps now offer features such as real-time spending alerts, personalized savings goals, and investment recommendations based on individual risk tolerance and financial objectives.

Furthermore, advancements in natural language processing have enabled these applications to incorporate chatbots and virtual assistants, allowing users to interact with their financial data in a more intuitive manner. This evolution not only enhances user engagement but also fosters a deeper understanding of personal finance among users.

Advantages of AI-Powered Financial Planning Apps

One of the most significant advantages of AI-powered financial planning apps is their ability to provide personalized recommendations based on individual user data. Unlike traditional financial advisors who may offer generic advice, these apps analyze a user’s financial history, spending habits, and future goals to deliver tailored insights. For instance, an app might suggest specific investment opportunities that align with a user’s risk profile or recommend adjustments to a budget based on recent spending patterns.

This level of personalization can empower users to make informed decisions that are more likely to lead to successful financial outcomes. Additionally, the efficiency of AI algorithms allows for real-time analysis and feedback. Users can receive immediate notifications about their spending habits or alerts when they are nearing their budget limits.

This instant feedback loop encourages proactive financial management and helps users stay on track with their financial goals. Moreover, the automation of routine tasks—such as bill payments and investment rebalancing—frees users from the burden of manual management, allowing them to focus on broader financial strategies. The combination of personalized insights and automation positions AI-powered financial planning apps as invaluable tools for modern consumers.

Challenges and Limitations of AI-Powered Financial Planning Apps

Despite their many advantages, AI-powered financial planning apps are not without challenges and limitations. One significant concern is the reliance on data quality and accuracy.

For example, if a user fails to input all their income sources or expenses accurately, the app’s budgeting suggestions could lead to unrealistic expectations or poor financial decisions. Another challenge lies in the complexity of financial situations that some users may face. While AI can analyze patterns and trends effectively, it may struggle with unique or nuanced circumstances that require human judgment or expertise.

For instance, individuals with complex tax situations or those navigating significant life changes—such as divorce or inheritance—may benefit from the nuanced understanding that a human advisor can provide. In such cases, relying solely on an AI-powered app may not yield the best outcomes.

The Role of AI in Personalized Financial Advice

AI plays a pivotal role in delivering personalized financial advice by leveraging vast datasets and advanced algorithms to tailor recommendations for individual users. By analyzing historical data, spending patterns, and even external economic indicators, AI can identify trends that inform personalized strategies for saving, investing, and spending. For example, an app might analyze a user’s past investment performance alongside market trends to suggest adjustments that could enhance returns while minimizing risk.

Moreover, machine learning capabilities enable these applications to continuously improve their recommendations over time. As users interact with the app and provide feedback—whether through explicit inputs or implicit behavior—the algorithms learn and adapt to better serve individual needs. This dynamic approach allows for a level of personalization that traditional financial advisors may struggle to achieve consistently.

The result is a more engaging user experience that fosters trust and encourages users to take an active role in managing their finances.

The Impact of AI-Powered Financial Planning Apps on Traditional Financial Services

The emergence of AI-powered financial planning apps has had a profound impact on traditional financial services, challenging established business models and prompting a reevaluation of how financial advice is delivered. As consumers increasingly turn to these digital solutions for their financial needs, traditional advisors face pressure to adapt or risk losing clients. Many established firms are now integrating technology into their service offerings, recognizing that clients expect a blend of human expertise and digital convenience.

This shift has also led to increased competition within the industry. New entrants leveraging AI technology can offer lower fees and more accessible services compared to traditional firms with higher overhead costs. As a result, established players are compelled to innovate and enhance their value propositions to retain clients.

This competitive landscape has spurred advancements in service delivery models, including hybrid approaches that combine human advisors with AI-driven tools to provide comprehensive support tailored to client needs.

Ethical and Privacy Considerations in AI-Powered Financial Planning Apps

As with any technology that handles sensitive personal information, ethical and privacy considerations are paramount in the realm of AI-powered financial planning apps. Users entrust these applications with their financial data, which raises concerns about data security and potential misuse. Financial institutions must implement robust security measures to protect user information from breaches or unauthorized access.

Additionally, transparency regarding how data is collected, stored, and utilized is essential for building trust with users. Moreover, ethical considerations extend beyond data security; they also encompass issues related to algorithmic bias and fairness. If the underlying algorithms are not designed with inclusivity in mind, there is a risk that certain demographic groups may receive suboptimal advice or be excluded from beneficial opportunities altogether.

Ensuring that AI systems are trained on diverse datasets can help mitigate these risks and promote equitable access to financial resources.

The Future of AI-Powered Financial Planning Apps: Trends and Predictions

Looking ahead, the future of AI-powered financial planning apps appears promising as technology continues to evolve at an unprecedented pace. One notable trend is the increasing integration of advanced analytics and predictive modeling capabilities into these applications. As machine learning algorithms become more sophisticated, they will be able to provide even more accurate forecasts regarding market trends and individual investment performance.

Additionally, the rise of open banking initiatives is likely to further enhance the functionality of these apps by allowing them to access a broader range of financial data across different institutions. This interconnectedness will enable more comprehensive insights into users’ overall financial health and facilitate better decision-making processes. Furthermore, as consumers become more aware of the importance of sustainable investing and ethical finance practices, we can expect AI-powered apps to incorporate features that align with these values.

This could include tools for assessing the environmental impact of investments or providing options for socially responsible investing. In conclusion, as AI technology continues to advance and reshape the landscape of personal finance management, we can anticipate a future where AI-powered financial planning apps play an increasingly central role in helping individuals achieve their financial goals while navigating an ever-changing economic environment.

In the rapidly evolving landscape of financial technology, AI-powered financial planning apps are becoming increasingly sophisticated, offering users personalized insights and streamlined management of their finances. A related article that delves into the technological advancements in consumer electronics is com/exploring-the-features-of-the-samsung-galaxy-book-odyssey/’>Exploring the Features of the Samsung Galaxy Book Odyssey.

This article highlights the cutting-edge features of the Samsung Galaxy Book Odyssey, showcasing how modern devices are equipped to support advanced applications, including those for financial planning. As technology continues to advance, the integration of powerful hardware and intelligent software will play a crucial role in shaping the future of financial management tools.

FAQs

What are AI-powered financial planning apps?

AI-powered financial planning apps are software applications that use artificial intelligence and machine learning algorithms to provide personalized financial advice and assistance to users. These apps analyze a user’s financial data, such as income, expenses, and investment portfolio, to offer tailored recommendations for budgeting, saving, investing, and retirement planning.

How do AI-powered financial planning apps work?

AI-powered financial planning apps work by collecting and analyzing a user’s financial information, including bank account transactions, credit card statements, and investment accounts. The apps use machine learning algorithms to identify patterns and trends in the user’s financial behavior and provide personalized recommendations for improving their financial health.

What are the benefits of using AI-powered financial planning apps?

Some benefits of using AI-powered financial planning apps include personalized financial advice, automated budgeting and saving recommendations, investment portfolio optimization, retirement planning assistance, and real-time financial insights. These apps can also help users track their spending, identify potential cost-saving opportunities, and make informed financial decisions.

Are AI-powered financial planning apps secure?

AI-powered financial planning apps prioritize the security and privacy of users’ financial data. They typically use encryption and other security measures to protect sensitive information and comply with industry regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). Users should always review the privacy and security policies of any app before providing their financial information.

What is the future of AI-powered financial planning apps?

The future of AI-powered financial planning apps is expected to involve further advancements in machine learning and artificial intelligence technology, leading to even more personalized and accurate financial advice. These apps may also integrate with other financial services, such as banking and investment platforms, to offer a comprehensive and seamless user experience. Additionally, regulatory changes and advancements in data privacy and security measures will continue to shape the future of these apps.