As a reader, you may be considering ways to engage with the financial markets, particularly if you are new to investing or have limited capital. This article explores micro-investing platforms, focusing on their core functionalities: fractional shares and autosave features. These platforms have democratized access to investing, traditionally an arena requiring substantial upfront capital, by breaking down barriers to entry.

Micro-investing platforms represent a significant shift in the personal finance landscape. Historically, investing in the stock market often involved purchasing whole shares, which could be prohibitively expensive for many individuals, especially for high-value stocks. The advent of these platforms has allowed individuals to invest smaller sums of money, making participation in the financial markets more accessible.

Defining Micro-Investing

Micro-investing is broadly defined as the practice of investing small amounts of money regularly. This can range from a few dollars a week to spare change rounded up from daily transactions. The core principle is consistent, low-threshold investment, fostering a habit of saving and investing over time. Unlike traditional brokerage accounts that might have minimum deposit requirements in the hundreds or thousands of dollars, many micro-investing platforms allow users to start with as little as one dollar.

Historical Context and Evolution

The concept of investing small sums is not entirely new, but the widespread accessibility and technological implementation are. Early forms of saving through small, consistent contributions can be seen in savings accounts and credit unions. However, these rarely offered direct exposure to equity markets. The digital revolution, coupled with decreasing transaction costs and innovative financial technology (fintech), paved the way for dedicated micro-investing platforms. These platforms leveraged mobile applications and user-friendly interfaces to attract a new generation of investors. Early pioneers in this space demonstrated the viability of a business model built around catering to small-scale investors.

Micro-investing platforms have gained popularity for their ability to offer fractional shares and autosave features, making investing accessible to a broader audience. For those interested in how technology is transforming various aspects of our lives, a related article discusses the impact of smartwatches in the workplace. You can read more about this innovative shift in the article titled “How Smartwatches Are Revolutionizing the Workplace” at this link.

Fractional Shares: Breaking Down Barriers

One of the cornerstones of micro-investing platforms is the ability to purchase fractional shares. This innovation fundamentally alters how individuals can invest in high-value companies.

What are Fractional Shares?

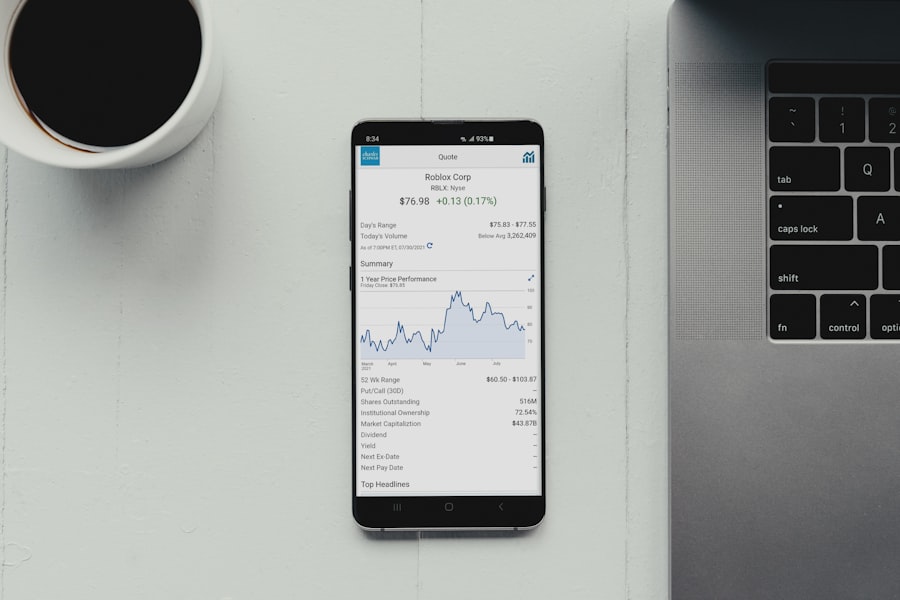

Fractional shares are portions of a single share of stock. Instead of buying one whole share of a company, an investor can purchase a fraction of that share, often down to several decimal places. For example, if a share of Amazon (AMZN) costs $150, and you only have $25 to invest, you can purchase 0.1666 of that Amazon share. This allows investors to diversify their portfolios across multiple companies, even with modest capital. Think of it like buying a slice of pizza instead of the whole pie – you still get to taste the flavor without committing to the entire purchase.

How Fractional Shares Work

When you place an order for a fractional share, the platform typically aggregates these smaller orders from multiple users. The platform then purchases whole shares in the open market and allocates the corresponding fractions to individual investors. While you technically own a portion of a share, for all intents and purposes, you participate in the gains and losses of that underlying stock proportionally. Dividends, if applicable, are also paid out proportionally to the fraction of the share owned.

Advantages of Fractional Shares

The primary advantage is market accessibility. High-priced stocks, once out of reach for many small investors, become attainable. This allows for immediate diversification. Instead of saving up for one expensive share, you can spread your investment across several companies or even exchange-traded funds (ETFs) with smaller amounts of capital. This diversification, even at a small scale, can help mitigate risk, as the performance of one struggling asset has less impact on the overall portfolio. Fractional shares also encourage consistent investing, as the hurdle of accumulating enough capital for a whole share is removed.

Disadvantages and Considerations

While beneficial, fractional shares do have some limitations. Not all brokers offer fractional share trading, although its prevalence is growing. You may not be able to transfer fractional shares between different brokerage accounts as easily as whole shares; often, they must be sold and repurchased. Additionally, some platforms might have limitations on the types of assets available for fractional share trading, focusing primarily on widely traded stocks and ETFs. It is also important to note that while fractional shares democratize access, they do not diminish the inherent risks associated with stock market investing.

Autosave Features: The Power of Automation

Beyond fractional shares, autosave features are another cornerstone of micro-investing platforms, designed to cultivate consistent investment habits without active effort.

Implementing Regular Contributions

Autosave functions allow users to set up recurring transfers of a specified amount from their linked bank account to their investment account. This can be daily, weekly, bi-weekly, or monthly, depending on the platform and user preference. This automation removes the psychological barrier of manually initiating investments, ensuring consistent contributions. This is akin to setting up a direct deposit into a savings account, but with the added benefit of immediate market exposure.

Round-Ups and Spare Change Investing

A unique and popular autosave feature is “round-up” or “spare change” investing. These features typically link to your everyday spending accounts (e.g., debit cards, credit cards). When you make a purchase, the platform rounds up the transaction to the nearest dollar and invests the difference. For example, if you buy coffee for $3.50, 50 cents would be automatically routed into your investment account. This method makes investing feel almost passive and effortless, accumulating small amounts without significant impact on daily budgets. It’s like finding loose change in your couch cushions, but instead of spending it, you’re putting it to work.

Behavioral Economics and Automation

The effectiveness of autosave features is rooted in principles of behavioral economics. Humans often struggle with “present bias,” prioritizing immediate gratification over future benefits. Automation bypasses this bias by making saving and investing the default option. By removing the need for active decision-making at each investment interval, autosave fosters a habit of regular contributions, leveraging “set it and forget it” psychology. This consistent investing, regardless of market fluctuations, also benefits from dollar-cost averaging, a strategy discussed further in the portfolio management section.

Platform Features and Offerings

Micro-investing platforms have evolved to offer a range of features designed to cater to their target audience.

Account Types and Investment Options

Most micro-investing platforms offer taxable brokerage accounts. Some also provide Individual Retirement Accounts (IRAs), such as Roth IRAs or Traditional IRAs, allowing users to invest for retirement with the associated tax advantages. The investment options typically include individual stocks available for fractional purchasing, and increasingly, exchange-traded funds (ETFs). ETFs offer instant diversification across various asset classes, sectors, or market indices, making them a popular choice for passive investors. Some platforms may also offer curated portfolios based on risk tolerance.

Fees and Pricing Models

Fee structures vary significantly among platforms. Some operate on a subscription model, charging a small monthly fee (e.g., $1 to $5). Others may charge a percentage of assets under management (AUM), typically a low percentage (e.g., 0.25% annually). Some platforms may offer commission-free trading for stocks and ETFs, especially if they operate on a subscription model. It is crucial for the reader to understand the fee structure and how it impacts their net returns, especially given the small investment amounts involved. Even small percentages can erode returns over time if ignored.

User Interface and Educational Resources

The success of micro-investing platforms largely depends on their user-friendly interfaces, often designed as mobile applications. These apps aim to simplify the investing process, making it intuitive for novice investors. Many platforms also offer educational resources, such as articles, tutorials, and financial literacy content. These resources often explain basic investing concepts, portfolio diversification, and long-term wealth building, empowering users to make informed decisions.

Security and Regulation

As with any financial service, security and regulation are paramount. Reputable micro-investing platforms are typically regulated by financial authorities, such as the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) in the United States. They are also usually members of the Securities Investor Protection Corporation (SIPC), which protects investors up to $500,000 (including $250,000 for cash) in case the brokerage firm fails. Platforms employ various security measures, including encryption, two-factor authentication, and robust data protection protocols, to safeguard user information and assets.

Micro-investing platforms have gained popularity for their ability to make investing accessible to everyone, particularly through features like fractional shares and autosave options. These tools allow users to invest small amounts of money regularly, making it easier to build a portfolio over time. For those interested in exploring how technology can enhance productivity and creativity, a related article discusses the innovative capabilities of the Samsung Galaxy Book Flex2 Alpha, which can complement your investing journey by providing a powerful tool for managing your finances. You can read more about it here.

Building a Portfolio with Micro-Investing

| Platform | Fractional Shares | Autosave Feature | Minimum Investment | Fees | Average User Rating |

|---|---|---|---|---|---|

| Acorns | Yes | Yes (Round-ups & Recurring) | 1 | 1.00 per month | 4.5/5 |

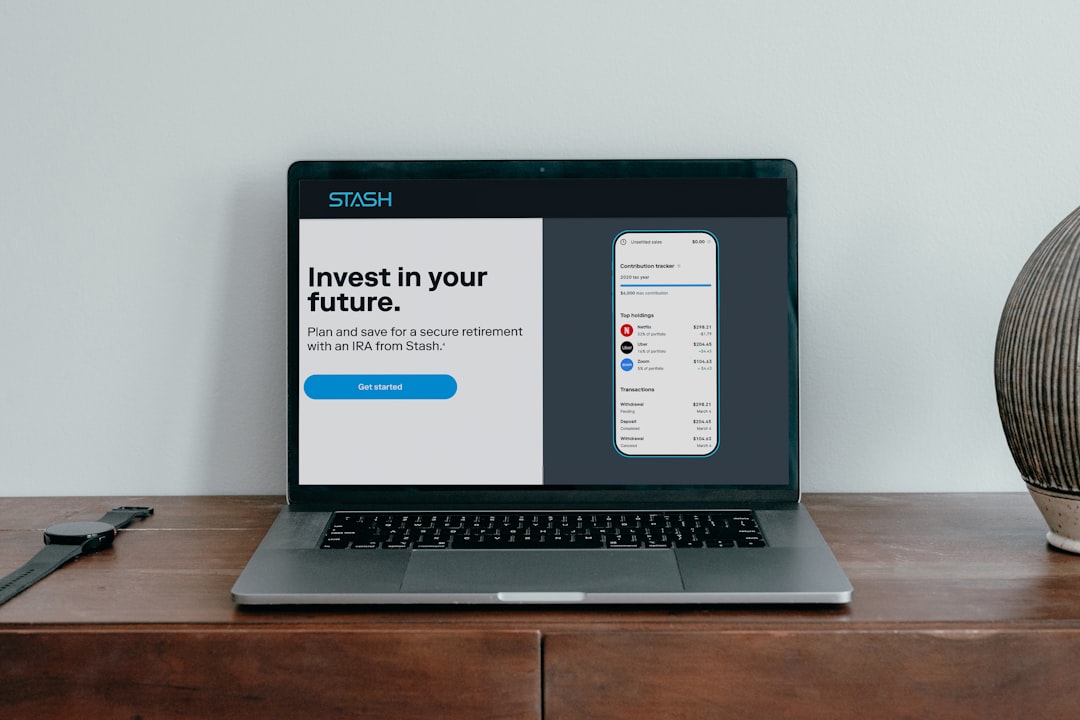

| Stash | Yes | Yes (Recurring Investments) | 5 | 1.00 per month | 4.3/5 |

| Robinhood | Yes | No | 0 | 0 | 4.0/5 |

| M1 Finance | Yes | Yes (Recurring Deposits) | 100 | 0 | 4.4/5 |

| Public | Yes | No | 0 | 0 | 4.2/5 |

Micro-investing platforms can be powerful tools for building diversified portfolios, even for those starting with limited capital. The strategy employed is often focused on long-term growth and consistent contributions.

Diversification Strategies

Even with small amounts, diversification is key. Instead of putting all your resources into one company, consider spreading your investments across several different stocks or, more effectively, utilizing ETFs. ETFs allow you to own a piece of many companies or even entire market indices (like the S&P 500) with a single purchase. This strategy reduces the risk associated with the poor performance of any single asset. For example, if you invest $50, you could allocate $10 to five different ETFs, gaining exposure to various sectors and geographies.

Dollar-Cost Averaging

The autosave features perfectly complement the investment strategy of dollar-cost averaging. This involves investing a fixed amount of money at regular intervals, regardless of the asset’s price fluctuations. When prices are high, your fixed amount buys fewer shares; when prices are low, it buys more shares. Over time, this strategy tends to average out your purchase price, reducing the impact of short-term market volatility and potentially leading to a lower average cost per share than if you tried to time the market. It removes emotion from the investment process, which is often a significant benefit for new investors.

Long-Term Growth and Compounding

The true power of micro-investing, especially when combined with autosave and fractional shares, lies in the principle of compounding. Compounding means earning returns not only on your initial principal but also on the accumulated interest and capital gains from previous periods. Even small, consistent contributions, when given enough time, can grow into substantial sums due to this exponential effect. This is why starting early, even with modest amounts, is often emphasized in personal finance. Compound interest is often referred to as the “eighth wonder of the world” for good reason.

Rebalancing and Portfolio Management

While micro-investing platforms simplify access, investors should still periodically review their portfolios. Rebalancing involves adjusting the asset allocation to maintain your desired risk level. For example, if one asset class has performed exceptionally well and now represents a larger portion of your portfolio than intended, you might sell some of it and invest in underperforming assets to bring your portfolio back to its target allocation. Some platforms offer automated rebalancing features for curated portfolios, further simplifying management.

Micro-investing platforms have gained popularity by allowing users to invest in fractional shares and utilize autosave features, making investing more accessible to everyone. For those interested in exploring innovative financial tools, a related article discusses the impact of advanced technology on investment strategies. You can read more about it in this insightful piece on keyword research tools that are transforming how investors approach their financial goals.

Who Benefits from Micro-Investing?

Micro-investing is not a one-size-fits-all solution, but it particularly benefits certain demographics and financial situations.

New Investors and Young Professionals

For individuals new to investing, micro-investing platforms serve as an excellent entry point. They remove the intimidating barriers of high minimums and complex interfaces, allowing new investors to learn the ropes with smaller stakes. Young professionals, often burdened with student loan debt or limited discretionary income, can leverage these platforms to start building wealth without significant financial strain. It instills a discipline of saving and investing early in their financial journey.

Individuals with Limited Disposable Income

Those with limited disposable income might find traditional investing out of reach. Micro-investing, through its spare change features and low contribution options, makes investing feasible. It allows individuals to put even small, seemingly insignificant amounts of money to work, preventing them from feeling excluded from wealth-building opportunities. This democratizes access to financial growth regardless of income level.

Developing a Savings and Investment Habit

Perhaps one of the most significant benefits is the cultivation of a consistent savings and investment habit. By automating contributions and making them almost imperceptible (as with round-ups), these platforms help users build financial discipline. This habit can then be scaled up as income and financial literacy grow, leading to more substantial investments down the line. It transforms sporadic saving into a systematic approach to financial growth.

Education and Financial Literacy Tool

Beyond simply investing, these platforms often serve as educational tools. By exposing users to the mechanics of the market, basic portfolio construction, and the concept of long-term growth, they contribute to an increase in financial literacy. Users can observe how market fluctuations affect their small investments, providing practical, hands-on learning without the risk of large capital losses typical of traditional, higher-stakes investing.

In conclusion, micro-investing platforms, through their innovative use of fractional shares and automated savings features, have significantly lowered the barrier to entry for stock market participation. They empower individuals to start investing with minimal capital, build diversified portfolios, and cultivate consistent financial habits, all while learning about the financial markets in a practical, accessible manner. As a reader considering your investment options, understanding these tools can be a crucial step in your financial journey.

FAQs

What are micro-investing platforms?

Micro-investing platforms are digital services that allow individuals to invest small amounts of money, often by purchasing fractional shares of stocks or ETFs. These platforms make investing accessible to people who may not have large sums of capital to start with.

What are fractional shares?

Fractional shares are portions of a whole share of a stock or ETF. Instead of buying a full share, investors can purchase a fraction, enabling them to invest smaller amounts and diversify their portfolios more easily.

How does the autosave feature work on micro-investing platforms?

The autosave feature automatically transfers small amounts of money from a linked bank account into the investment account at regular intervals. This helps users consistently invest without needing to manually make deposits.

Are there fees associated with micro-investing platforms?

Many micro-investing platforms charge low or no fees, but some may have subscription fees, transaction fees, or management fees. It’s important to review each platform’s fee structure before investing.

Who can benefit from using micro-investing platforms?

Micro-investing platforms are ideal for beginners, individuals with limited funds, or those who want to build an investment habit gradually. They provide an easy and affordable way to start investing and grow wealth over time.