The digital banking landscape has undergone a significant transformation in recent years, driven by the rapid advancement of technology and the increasing demand for personalized financial services. At the heart of this evolution lies smart analytics, a powerful tool that enables banks to harness vast amounts of data to gain insights into customer behavior, preferences, and needs. Smart analytics encompasses a range of techniques, including data mining, machine learning, and predictive modeling, which collectively empower financial institutions to make informed decisions and enhance their service offerings.

As banks strive to remain competitive in an increasingly crowded marketplace, the ability to analyze and interpret data effectively has become paramount. Smart analytics not only facilitates a deeper understanding of customer behavior but also allows banks to tailor their products and services to meet the unique demands of their clientele. By leveraging data-driven insights, financial institutions can foster stronger relationships with customers, improve operational efficiency, and ultimately drive growth in an era where customer expectations are at an all-time high.

Key Takeaways

- Smart analytics in digital banking is revolutionizing the way banks understand and engage with their customers.

- Data analysis allows banks to gain valuable insights into customer behavior, preferences, and needs.

- Predictive analytics enables banks to personalize customer experiences and offer tailored products and services.

- Machine learning helps banks to target their marketing strategies more effectively and efficiently.

- Enhanced fraud detection and security measures are crucial for maintaining customer trust and confidence in digital banking.

Understanding Customer Behavior through Data Analysis

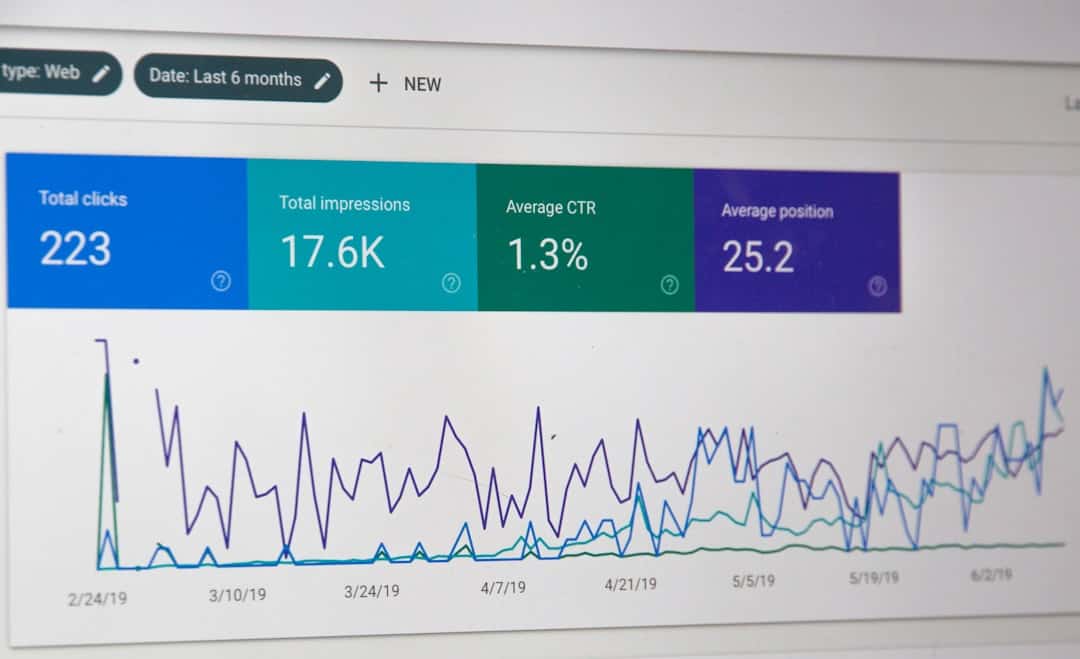

Uncovering Insights through Data Analysis

For instance, transaction data can be analyzed to identify spending habits, preferred payment methods, and even seasonal fluctuations in consumer behavior.

Targeted Strategies through Customer Segmentation

By segmenting customers based on these insights, banks can develop targeted strategies that resonate with specific demographics. Moreover, advanced analytics tools enable banks to track customer journeys across various touchpoints, from online banking platforms to mobile applications.

Enhancing the Customer Experience

This comprehensive view allows institutions to identify pain points in the customer experience and address them proactively. For example, if data analysis reveals that a significant number of customers abandon their online applications at a particular stage, banks can investigate the underlying issues and implement changes to streamline the process. By continuously monitoring customer behavior through data analysis, banks can adapt their strategies in real-time, ensuring they remain aligned with evolving customer needs.

Personalizing Customer Experience with Predictive Analytics

Predictive analytics plays a pivotal role in personalizing the customer experience within digital banking. By utilizing historical data and advanced algorithms, banks can forecast future customer behavior and preferences. This capability allows financial institutions to offer tailored recommendations and services that align with individual needs.

For instance, if predictive models indicate that a customer is likely to apply for a mortgage based on their financial history and current life events, banks can proactively reach out with personalized mortgage offers. Furthermore, predictive analytics can enhance cross-selling opportunities by identifying complementary products that may interest customers. For example, if a customer frequently uses their credit card for travel-related purchases, banks can suggest travel insurance or rewards programs tailored to their preferences.

This level of personalization not only improves customer satisfaction but also drives revenue growth for banks by increasing the likelihood of product uptake.

Utilizing Machine Learning for Targeted Marketing Strategies

Machine learning has emerged as a game-changer in the realm of targeted marketing strategies within digital banking. By analyzing vast datasets, machine learning algorithms can identify complex patterns that traditional methods may overlook. This capability enables banks to segment their customer base more effectively and develop highly targeted marketing campaigns that resonate with specific groups.

For instance, machine learning can analyze customer demographics, transaction history, and online behavior to create detailed profiles of potential customers. Banks can then tailor their marketing messages based on these profiles, ensuring that promotions are relevant and timely. Additionally, machine learning models can continuously learn from new data inputs, allowing banks to refine their marketing strategies over time.

Moreover, machine learning can optimize advertising spend by predicting which channels will yield the highest return on investment. By analyzing past campaign performance and customer engagement metrics, banks can allocate resources more efficiently, focusing on the channels that drive the most conversions.

This data-driven approach not only maximizes marketing effectiveness but also enhances overall customer engagement.

Improving Fraud Detection and Security Measures

In an era where digital transactions are increasingly prevalent, ensuring security is paramount for banks. Smart analytics plays a crucial role in improving fraud detection and security measures by enabling real-time monitoring of transactions and identifying suspicious activities. Advanced algorithms can analyze transaction patterns and flag anomalies that deviate from established norms, allowing banks to respond swiftly to potential threats.

For example, if a customer’s account experiences a sudden surge in transactions from an unfamiliar location or device, smart analytics can trigger alerts for further investigation. This proactive approach not only helps prevent fraudulent activities but also enhances customer trust in the bank’s security measures. Additionally, machine learning models can continuously adapt to new fraud tactics by learning from historical data, ensuring that detection mechanisms remain robust against evolving threats.

Furthermore, smart analytics can enhance identity verification processes by analyzing behavioral biometrics. By assessing factors such as typing speed, mouse movements, and device usage patterns, banks can create unique profiles for each user. This information can be used to authenticate customers during online transactions, adding an extra layer of security while minimizing friction in the user experience.

Enhancing Customer Service through Real-time Data Insights

Real-time data insights are transforming customer service in digital banking by enabling institutions to respond promptly to customer inquiries and issues. With access to up-to-the-minute information about account activity and transaction history, customer service representatives can provide personalized assistance that addresses specific concerns. For instance, if a customer contacts support regarding a recent transaction dispute, representatives can quickly access relevant data to resolve the issue efficiently.

Moreover, real-time analytics can empower banks to anticipate customer needs before they arise. By monitoring customer interactions across various channels—such as chatbots, mobile apps, and social media—banks can identify trends and common queries.

Additionally, integrating real-time data insights into customer service platforms enables banks to track performance metrics such as response times and resolution rates. By analyzing this data, institutions can identify areas for improvement and implement targeted training programs for staff. This commitment to continuous improvement not only enhances service quality but also fosters a culture of accountability within the organization.

Leveraging Data for Proactive Customer Retention Strategies

Customer retention is a critical focus for banks seeking sustainable growth in a competitive environment. Leveraging data analytics allows financial institutions to develop proactive retention strategies that address potential churn before it occurs. By analyzing customer behavior patterns and engagement levels, banks can identify at-risk customers who may be considering switching to competitors.

For instance, if data analysis reveals a decline in account activity or increased complaints from a particular segment of customers, banks can implement targeted outreach initiatives aimed at re-engaging these individuals. Personalized communication—such as tailored offers or loyalty rewards—can incentivize customers to remain loyal to the institution. Additionally, feedback mechanisms can be established to gather insights directly from customers about their experiences and preferences.

Furthermore, predictive analytics can help banks forecast which customers are most likely to leave based on historical data trends. By understanding the factors contributing to churn—such as dissatisfaction with fees or lack of product offerings—banks can implement strategic changes to address these issues proactively. This data-driven approach not only enhances customer satisfaction but also strengthens long-term loyalty.

The Future of Customer Retention in Digital Banking with Smart Analytics

As digital banking continues to evolve, the role of smart analytics in shaping customer retention strategies will only become more pronounced. Financial institutions that embrace data-driven decision-making will be better positioned to understand their customers’ needs and preferences while delivering personalized experiences that foster loyalty. The integration of advanced technologies such as machine learning and predictive analytics will enable banks to stay ahead of emerging trends and adapt their offerings accordingly.

In this dynamic landscape, the ability to leverage real-time insights will be crucial for maintaining competitive advantage. Banks that prioritize proactive engagement with customers—through targeted marketing efforts, enhanced security measures, and exceptional service—will cultivate lasting relationships built on trust and satisfaction. As the future unfolds, smart analytics will undoubtedly play a central role in redefining how banks interact with their customers and drive sustainable growth in an increasingly digital world.

If you are interested in the latest technology trends, you may also want to check out How to Choose the Best Smartphone for Gaming. This article provides valuable insights into selecting the right smartphone for an optimal gaming experience. Just like smart analytics enhance customer retention in digital banking, choosing the best smartphone for gaming can significantly impact your overall satisfaction with the device.

FAQs

What is customer retention in digital banking?

Customer retention in digital banking refers to the ability of a bank to keep its existing customers engaged and satisfied with its digital services, ultimately preventing them from switching to a competitor.

What are smart analytics in digital banking?

Smart analytics in digital banking involve the use of advanced data analysis techniques and tools to gain insights into customer behavior, preferences, and needs. This allows banks to make data-driven decisions to improve their services and enhance customer satisfaction.

How do smart analytics enhance customer retention in digital banking?

Smart analytics enhance customer retention in digital banking by enabling banks to personalize their services, offer targeted promotions, and proactively address customer needs and concerns. By understanding customer behavior and preferences, banks can tailor their offerings to better meet customer expectations, ultimately increasing satisfaction and loyalty.

What are some examples of how smart analytics can be used to enhance customer retention in digital banking?

Some examples of how smart analytics can enhance customer retention in digital banking include personalized product recommendations, targeted marketing campaigns, proactive customer support based on predictive analysis, and the development of customized financial solutions based on individual customer needs.

What are the benefits of using smart analytics for customer retention in digital banking?

The benefits of using smart analytics for customer retention in digital banking include improved customer satisfaction, increased customer loyalty, higher retention rates, reduced customer churn, and ultimately, a more profitable and sustainable banking business.