The financial technology sector, commonly referred to as FinTech, has emerged as a transformative force in the global economy. FinTech startups leverage technology to provide innovative financial services, often disrupting traditional banking models. These startups utilize advancements in mobile technology, artificial intelligence, and blockchain to create solutions that are more accessible, efficient, and user-friendly.

The rise of FinTech has been particularly significant in addressing the needs of underbanked communities—those individuals and families who lack access to conventional banking services due to various socio-economic barriers. FinTech startups are characterized by their agility and ability to adapt quickly to changing market demands. Unlike traditional banks, which often have cumbersome bureaucratic processes, these startups can pivot their offerings based on real-time feedback from users.

This flexibility allows them to tailor their services to meet the unique needs of underbanked populations, who often face challenges such as high fees, limited access to credit, and a lack of financial literacy. By focusing on inclusivity and accessibility, FinTech startups are not only reshaping the financial landscape but also empowering individuals who have historically been marginalized by the banking system.

Key Takeaways

- FinTech startups are revolutionizing the financial industry by leveraging technology to provide innovative solutions to traditional banking services.

- Underbanked communities face challenges in accessing financial services, including limited access to traditional banking institutions and financial products.

- FinTech startups are addressing the issue of financial inclusion by providing underbanked communities with access to affordable and convenient financial services.

- Innovative solutions from FinTech startups, such as mobile banking and digital payment platforms, are making it easier for underbanked communities to manage their finances and make transactions.

- The impact of FinTech on economic development in underbanked communities is significant, as it helps to stimulate economic growth and improve financial stability for individuals and businesses.

The Challenges of Underbanked Communities

Limited Access to Traditional Banking Services

One of the most pressing issues is the lack of access to traditional banking services. Many individuals in these communities do not have bank accounts, which can lead to reliance on costly alternatives such as payday loans or check-cashing services.

Cycle of Debt and Limited Credit Access

This reliance often results in a cycle of debt that is difficult to escape, perpetuating financial insecurity and limiting opportunities for economic advancement. Additionally, underbanked individuals often encounter barriers related to credit access. Without a formal banking history or credit score, obtaining loans or credit cards becomes nearly impossible.

Impact on Small Business Development and Community Growth

This lack of access not only stifles personal financial growth but also inhibits small business development within these communities. Entrepreneurs who cannot secure funding are unable to invest in their ventures, stunting local economic growth and innovation.

Access to Financial Services

Access to financial services is a fundamental component of economic empowerment. For underbanked communities, the absence of reliable banking options can severely limit their ability to save, invest, and plan for the future. Traditional banks often overlook these populations due to perceived risks or low profitability, leaving a significant gap in service provision.

This gap creates an environment where alternative financial services thrive, but these options frequently come with exorbitant fees and unfavorable terms. The digital divide also plays a crucial role in access to financial services. While mobile technology has the potential to bridge this gap, not all individuals in underbanked communities have equal access to smartphones or reliable internet connections.

This disparity can exacerbate existing inequalities, as those without access to technology are further marginalized from the financial system. Moreover, even when digital solutions are available, a lack of financial literacy can prevent individuals from effectively utilizing these tools. Thus, addressing access to financial services requires a multifaceted approach that considers both technological infrastructure and educational initiatives.

Innovative Solutions from FinTech Startups

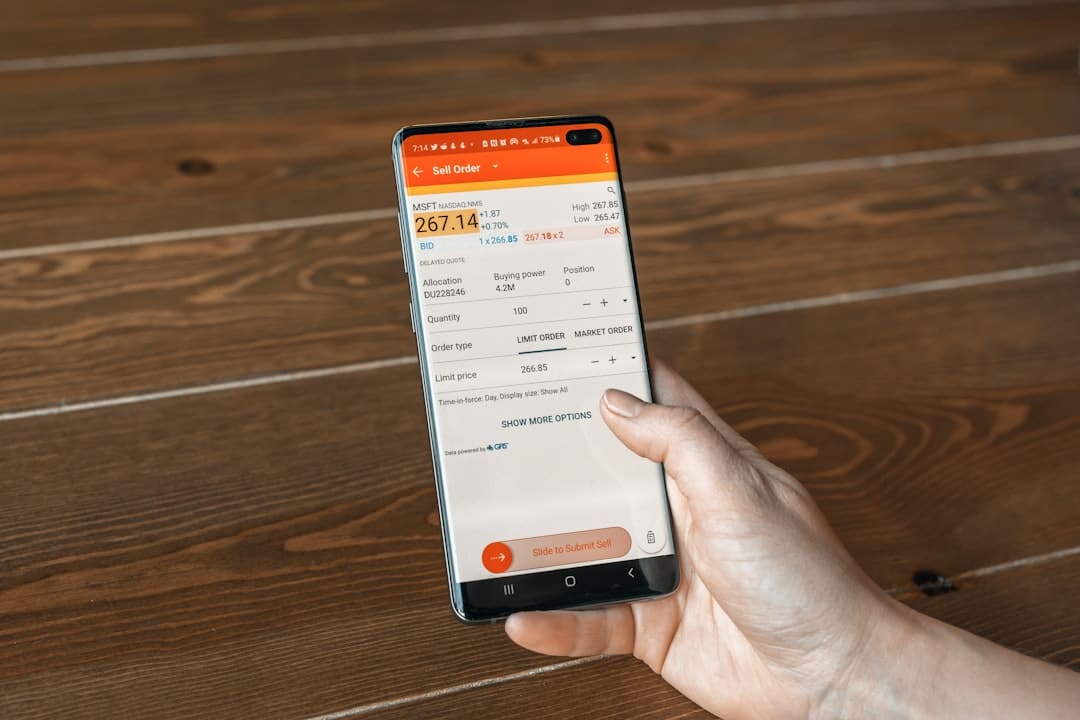

FinTech startups are at the forefront of developing innovative solutions tailored specifically for underbanked communities. One notable example is the rise of mobile banking applications that allow users to manage their finances directly from their smartphones. These apps often feature low or no fees, making them an attractive alternative for individuals who cannot afford traditional banking services.

Companies like Chime and Varo Money have gained traction by offering no-fee checking accounts and early direct deposit options, enabling users to access their funds more quickly. Another innovative solution is the use of alternative credit scoring models that take into account non-traditional data points such as utility payments, rental history, and even social media activity. Startups like Petal and Upstart are pioneering these models, allowing individuals with limited credit histories to qualify for loans based on their overall financial behavior rather than just their credit scores.

This approach not only broadens access to credit but also encourages responsible financial behavior among users who may have previously been excluded from the lending market.

Impact on Economic Development

The impact of FinTech solutions on economic development in underbanked communities is profound. By providing access to financial services, these startups empower individuals to take control of their finances, leading to increased savings and investment in local economies. When people have access to affordable banking options, they are more likely to save for emergencies, invest in education, or start small businesses—activities that contribute to overall economic growth.

Moreover, FinTech solutions can stimulate job creation within these communities. As more individuals gain access to credit and banking services, local entrepreneurs can launch or expand their businesses, creating jobs and fostering economic resilience. For instance, micro-lending platforms like Kiva allow individuals to lend small amounts of money directly to entrepreneurs in underbanked areas, facilitating business growth and community development.

This cycle of investment and growth not only benefits individual borrowers but also strengthens the local economy as a whole.

Collaboration with Traditional Financial Institutions

Enhancing Impact through Partnerships

While FinTech startups are making significant strides in serving underbanked communities, collaboration with traditional financial institutions can enhance their impact even further. Many established banks recognize the need to reach underserved populations but may lack the agility or technological expertise that FinTech companies possess. By partnering with these startups, traditional banks can leverage innovative technologies and approaches while expanding their customer base.

Integrating FinTech Solutions for Enhanced Services

For example, some banks have begun integrating FinTech solutions into their existing platforms to offer enhanced services such as budgeting tools or personalized financial advice.

Addressing Regulatory Compliance and Stability

Additionally, traditional banks can provide the regulatory compliance and stability that many FinTech startups may struggle with on their own. This symbiotic relationship can create a more robust financial ecosystem that benefits all parties involved.

Regulatory Considerations

As FinTech startups continue to grow and innovate, regulatory considerations become increasingly important. The rapid pace of technological advancement often outstrips existing regulations designed for traditional financial institutions. This creates a complex landscape where startups must navigate compliance while still maintaining their innovative edge.

Regulatory bodies are beginning to recognize the unique challenges posed by FinTech companies and are working towards creating frameworks that encourage innovation while protecting consumers. One area of focus is consumer protection, particularly for vulnerable populations such as those in underbanked communities. Regulations must ensure that FinTech solutions do not exploit these individuals through predatory lending practices or hidden fees.

Additionally, data privacy and security are paramount concerns as more personal information is shared through digital platforms. Striking a balance between fostering innovation and ensuring consumer protection will be crucial as the FinTech landscape continues to evolve.

The Future of FinTech in Underbanked Communities

Looking ahead, the future of FinTech in underbanked communities appears promising yet challenging. As technology continues to advance, new opportunities will arise for startups to develop solutions that address the specific needs of these populations. The integration of artificial intelligence and machine learning could lead to even more personalized financial products that cater to individual circumstances and preferences.

However, challenges remain in ensuring equitable access to these innovations. Efforts must be made to bridge the digital divide by improving internet access and digital literacy among underbanked populations. Additionally, ongoing collaboration between FinTech startups and traditional financial institutions will be essential in creating a comprehensive ecosystem that supports financial inclusion.

As we move forward into an increasingly digital future, it is imperative that stakeholders—including policymakers, community organizations, and financial institutions—work together to create an environment where everyone has access to the tools they need for economic empowerment. The potential for FinTech startups to transform the lives of individuals in underbanked communities is immense; harnessing this potential will require concerted efforts across multiple sectors.

In a similar vein to how FinTech startups are innovating in underbanked communities, there is an article on how to choose a tablet for students that discusses the importance of technology in education and ensuring that all students have access to the tools they need to succeed. Just as FinTech is revolutionizing the financial industry, technology in education is transforming the way students learn and engage with their studies. Both articles highlight the importance of leveraging technology to empower underserved communities and bridge the digital divide.

FAQs

What is FinTech?

FinTech, short for financial technology, refers to the use of technology to provide financial services. This can include anything from mobile banking apps to cryptocurrency.

What are underbanked communities?

Underbanked communities are areas or groups of people who have limited access to traditional banking services. This can be due to a variety of factors, including geographic location, income level, or lack of documentation.

How are FinTech startups innovating in underbanked communities?

FinTech startups are using technology to create new and innovative ways to provide financial services to underbanked communities. This can include mobile banking apps, peer-to-peer lending platforms, and microfinance services.

What are some examples of FinTech innovations for underbanked communities?

Examples of FinTech innovations for underbanked communities include mobile money transfer services, digital lending platforms, and blockchain-based financial services. These innovations aim to provide easier access to financial services for those who are traditionally underserved by traditional banks.

What are the benefits of FinTech innovations for underbanked communities?

The benefits of FinTech innovations for underbanked communities include increased access to financial services, lower transaction costs, and the ability to build credit and access loans. These innovations can also help to reduce the reliance on cash and improve financial inclusion.