In the rapidly evolving landscape of financial technology, digital wallets have emerged as a transformative tool for managing personal finances and facilitating transactions. A digital wallet, often referred to as an e-wallet, is a software application that allows users to store payment information and passwords for numerous payment methods and websites securely. This technology enables users to make electronic transactions seamlessly, whether in-store or online, by simply using their smartphones or other digital devices.

The rise of digital wallets can be attributed to the increasing reliance on mobile devices and the growing demand for convenience in financial transactions. The concept of digital wallets is not entirely new; however, their adoption has surged in recent years due to advancements in technology and changing consumer behaviors. With the proliferation of smartphones and the internet, consumers are increasingly seeking efficient ways to manage their finances.

Digital wallets provide a solution that combines ease of use with enhanced functionality, allowing users to store not only credit and debit card information but also loyalty cards, coupons, and even cryptocurrencies. As more businesses adopt contactless payment systems, the relevance of digital wallets continues to grow, making them an integral part of modern commerce.

Key Takeaways

- Digital wallets are virtual wallets that store payment information and can be used for online and in-store purchases.

- Advantages of using digital wallets include convenience, faster transactions, and the ability to store multiple payment methods in one place.

- Security features of digital wallets include encryption, tokenization, and biometric authentication to protect user information and prevent fraud.

- Types of digital wallets available include mobile wallets, online wallets, and hardware wallets, each with their own unique features and benefits.

- Digital wallets are impacting traditional payment methods by offering a more convenient and secure alternative, leading to a shift towards cashless transactions.

- The future of digital wallets is expected to include more advanced security features, increased integration with other technologies, and a wider acceptance by merchants.

- When choosing the right digital wallet, consider factors such as compatibility with your devices, security features, and the availability of your preferred payment methods.

- Tips for using digital wallets safely include setting up strong authentication methods, keeping software up to date, and being cautious when sharing personal information online.

Advantages of Using Digital Wallets

Speed and Efficiency

For instance, a consumer can simply tap their smartphone at a point-of-sale terminal equipped with Near Field Communication (NFC) technology to complete a transaction in seconds. This not only speeds up the checkout process but also enhances the overall shopping experience.

Financial Management Tools

Additionally, digital wallets often come with features that help users manage their finances more effectively. Many digital wallet applications provide transaction history, budgeting tools, and spending analytics, allowing users to track their expenses and make informed financial decisions.

Empowering Financial Awareness

For example, a user can easily categorize their spending by different categories such as groceries, dining out, or entertainment, providing valuable insights into their financial habits. This level of financial awareness can empower users to make better choices regarding their spending and saving.

Security Features of Digital Wallets

Security is a paramount concern for consumers when it comes to financial transactions, and digital wallets are designed with robust security features to protect sensitive information. One of the primary security measures employed by digital wallets is encryption. When a user stores their payment information within a digital wallet, that data is encrypted, making it nearly impossible for unauthorized parties to access it.

This encryption process ensures that even if a hacker were to intercept the data during transmission, they would be unable to decipher it. Moreover, many digital wallets utilize biometric authentication methods such as fingerprint recognition or facial recognition to enhance security further. These features add an additional layer of protection by ensuring that only the authorized user can access the wallet and initiate transactions.

For instance, Apple Pay requires users to authenticate their identity using Face ID or Touch ID before completing a payment, significantly reducing the risk of fraud. Additionally, many digital wallets offer real-time transaction alerts, allowing users to monitor their accounts for any unauthorized activity promptly.

Types of Digital Wallets Available

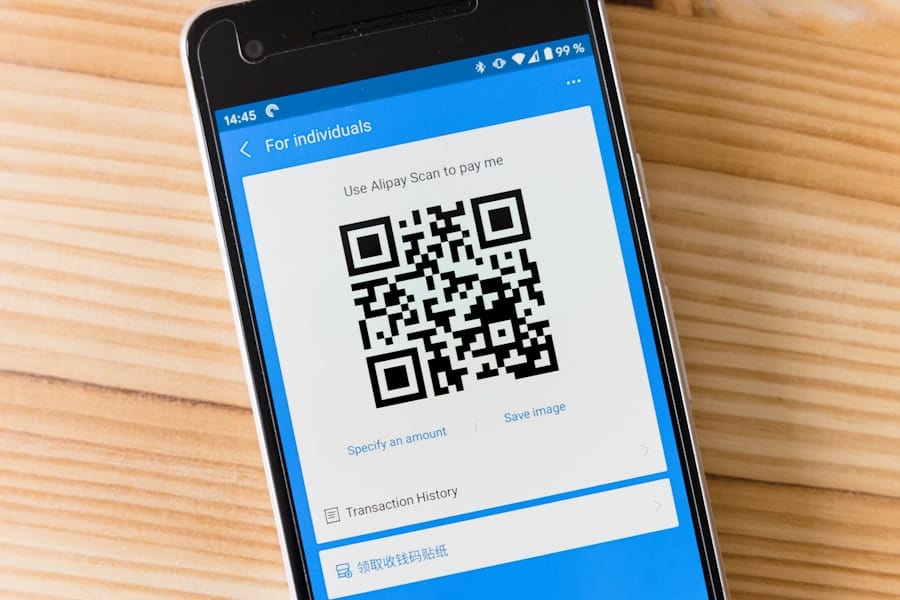

Digital wallets can be broadly categorized into several types, each serving different purposes and catering to various user needs. The most common types include mobile wallets, online wallets, and cryptocurrency wallets. Mobile wallets are applications installed on smartphones that allow users to make payments in-store or online using their mobile devices.

Examples include Apple Pay, Google Pay, and Samsung Pay. These wallets often leverage NFC technology for contactless payments and are widely accepted at retail locations. Online wallets, on the other hand, are web-based platforms that enable users to store payment information for online transactions.

PayPal is one of the most well-known online wallets, allowing users to send and receive money electronically without sharing their bank account details with merchants. Online wallets are particularly popular for e-commerce transactions due to their ease of use and widespread acceptance across various online retailers. Cryptocurrency wallets represent another category of digital wallets designed specifically for managing cryptocurrencies like Bitcoin and Ethereum.

These wallets can be either hardware-based or software-based and allow users to store, send, and receive digital currencies securely.

In contrast, software wallets like Coinbase offer more convenience for frequent transactions but may be more vulnerable to hacking attempts.

How Digital Wallets Are Impacting Traditional Payment Methods

The rise of digital wallets has significantly impacted traditional payment methods such as cash and credit cards. As consumers increasingly embrace the convenience and efficiency offered by digital wallets, businesses are adapting their payment systems accordingly. Many retailers now prioritize contactless payment options, recognizing that customers prefer quick and seamless transactions over traditional methods that may involve waiting for card swipes or cash handling.

This shift has led to a decline in cash usage in many regions around the world. According to a report by the World Bank, cash transactions accounted for only 20% of total payments in Sweden in 2020, highlighting a trend toward cashless societies driven by digital payment solutions. Furthermore, credit card companies are also adapting by integrating digital wallet capabilities into their services.

For example, Visa and Mastercard have developed partnerships with various digital wallet providers to facilitate smoother transactions and enhance customer experiences. Moreover, the integration of loyalty programs within digital wallets has further incentivized consumers to adopt these technologies over traditional payment methods. Retailers can offer personalized discounts and rewards directly through digital wallet applications, encouraging repeat business and fostering customer loyalty.

This integration not only benefits consumers but also provides businesses with valuable data on consumer behavior that can be leveraged for targeted marketing strategies.

The Future of Digital Wallets

As technology continues to advance at an unprecedented pace, the future of digital wallets appears promising and full of potential innovations. One significant trend is the increasing integration of artificial intelligence (AI) into digital wallet applications. AI can enhance user experiences by providing personalized recommendations based on spending habits or offering insights into budgeting strategies.

For instance, an AI-powered digital wallet could analyze a user’s transaction history and suggest ways to save money or identify recurring expenses that could be reduced. Another emerging trend is the expansion of digital wallets into new markets and demographics. As smartphone penetration increases in developing countries, there is a growing opportunity for digital wallets to facilitate financial inclusion for unbanked populations.

Mobile payment solutions like M-Pesa in Kenya have already demonstrated how digital wallets can empower individuals without access to traditional banking services by enabling them to conduct transactions via their mobile phones. Furthermore, as cryptocurrencies gain mainstream acceptance, we can expect digital wallets to evolve further by incorporating more advanced features for managing various types of digital assets. The ability to seamlessly transact with both fiat currencies and cryptocurrencies within a single wallet could revolutionize how consumers approach payments and investments.

How to Choose the Right Digital Wallet for You

Selecting the right digital wallet involves considering several factors that align with your personal needs and preferences. First and foremost, assess the types of transactions you plan to conduct regularly. If you primarily shop online, an online wallet like PayPal may be ideal due to its widespread acceptance among e-commerce platforms.

Conversely, if you frequently make in-store purchases, a mobile wallet like Apple Pay or Google Pay may offer greater convenience through contactless payments. Another critical consideration is security features. Look for digital wallets that offer robust encryption methods and multi-factor authentication options.

Researching user reviews and expert opinions can provide insights into the reliability and security track record of different wallet providers. Additionally, consider whether the wallet supports biometric authentication methods such as fingerprint or facial recognition for added security. Compatibility with your existing financial accounts is also essential when choosing a digital wallet.

Ensure that the wallet you select can easily link with your bank accounts or credit cards without excessive fees or complications. Some wallets may charge transaction fees or impose limits on transfers; understanding these terms upfront can help you avoid unexpected costs down the line.

Tips for Using Digital Wallets Safely

While digital wallets offer numerous advantages, it is crucial to use them safely to protect your financial information from potential threats. One fundamental tip is to enable two-factor authentication (2FA) whenever possible.

Regularly updating your device’s operating system and applications is another essential practice for maintaining security. Software updates often include critical security patches that protect against vulnerabilities exploited by cybercriminals. Additionally, be cautious when connecting your digital wallet to public Wi-Fi networks; using unsecured networks can expose your sensitive information to potential interception.

Lastly, monitor your transaction history frequently for any unauthorized activity. Most digital wallet applications provide real-time notifications for transactions made using your account; take advantage of this feature to stay informed about your spending patterns and detect any suspicious activity promptly. If you notice any discrepancies or unauthorized charges, report them immediately to your wallet provider for resolution.

By following these safety tips and remaining vigilant about your digital wallet usage, you can enjoy the convenience of modern payment solutions while minimizing risks associated with online transactions.

Digital wallets are revolutionizing the way we make payments, but they are not the only technology changing the game. Smartwatches are also enhancing connectivity and streamlining the payment process. In a recent article on how smartwatches are enhancing connectivity, the benefits of wearable technology in making transactions easier and more convenient are explored. Just like digital wallets, smartwatches are becoming increasingly popular for their ability to simplify the payment process and provide a seamless user experience.

FAQs

What is a digital wallet?

A digital wallet is a software-based system that securely stores users’ payment information and passwords for numerous payment methods and websites. By using a digital wallet, users can complete purchases easily and quickly with near-field communication technology.

How are digital wallets replacing traditional payment methods?

Digital wallets are replacing traditional payment methods by offering a more convenient and secure way to make transactions. With digital wallets, users can store multiple payment methods in one place and make purchases online or in-store without the need to carry physical cards or cash.

What are the benefits of using a digital wallet?

Some benefits of using a digital wallet include faster and more convenient transactions, enhanced security features such as encryption and tokenization, the ability to store multiple payment methods in one place, and the ability to make contactless payments using near-field communication technology.

What are some popular digital wallet providers?

Some popular digital wallet providers include Apple Pay, Google Pay, Samsung Pay, PayPal, Venmo, and Cash App. These providers offer a range of features and capabilities, such as peer-to-peer payments, loyalty program integration, and in-app purchases.

Are digital wallets secure?

Digital wallets are designed with security in mind and often use encryption and tokenization to protect users’ payment information. Additionally, many digital wallet providers offer features such as biometric authentication and transaction alerts to enhance security.