In recent years, the landscape of banking has undergone a significant transformation, particularly in emerging markets where traditional banking infrastructure has often been lacking. Digital-first banking services have surged in popularity, driven by the proliferation of smartphones and internet access. These services offer a range of financial products and solutions that cater to the unique needs of consumers in regions where conventional banks may not have a physical presence.

For instance, countries like Kenya have seen the meteoric rise of mobile money platforms such as M-Pesa, which has revolutionized how individuals conduct transactions, save money, and access credit. This shift towards digital-first banking is not merely a trend; it represents a fundamental change in how financial services are delivered and consumed. The rise of digital-first banking services is also fueled by the increasing demand for convenience and accessibility among consumers.

In many emerging markets, individuals often face long distances to reach bank branches, limited operating hours, and bureaucratic hurdles that can deter them from engaging with traditional financial institutions. Digital banking platforms eliminate these barriers by providing users with the ability to manage their finances from the comfort of their homes or on-the-go. This accessibility is particularly crucial for populations in rural areas, where traditional banking services may be sparse.

As a result, digital-first banking is not only reshaping consumer behavior but also redefining the competitive landscape for financial service providers.

Key Takeaways

- Digital-first banking services are on the rise in emerging markets, providing convenient and accessible financial solutions to a growing number of consumers.

- Technology has had a significant impact on financial inclusion in developing countries, allowing more people to access banking services and participate in the formal economy.

- Mobile banking plays a crucial role in bridging the gap for underserved communities, offering a convenient and secure way to manage finances and access essential banking services.

- While digital-first banking offers many advantages such as increased accessibility and efficiency, it also presents challenges such as the need for robust infrastructure and digital literacy.

- Cybersecurity is of utmost importance in the expansion of digital banking services, as the reliance on digital platforms increases the risk of cyber threats and fraud.

The Impact of Technology on Financial Inclusion in Developing Countries

Technology has emerged as a powerful catalyst for financial inclusion in developing countries, enabling millions of individuals to access financial services that were previously out of reach. The advent of digital banking solutions has allowed underserved populations to participate in the formal economy, fostering economic growth and stability. For example, in India, the introduction of the Unified Payments Interface (UPI) has facilitated seamless peer-to-peer transactions, allowing users to send and receive money instantly using their smartphones.

This technological advancement has significantly reduced the reliance on cash transactions and has empowered individuals to engage in commerce more effectively. Moreover, technology-driven financial services have the potential to address the unique challenges faced by marginalized communities. For instance, microfinance institutions are leveraging digital platforms to provide small loans to entrepreneurs who lack access to traditional credit sources.

By utilizing data analytics and alternative credit scoring methods, these institutions can assess the creditworthiness of borrowers who may not have a formal credit history. This innovative approach not only enhances financial inclusion but also stimulates local economies by supporting small businesses and fostering entrepreneurship.

The Role of Mobile Banking in Bridging the Gap for Underserved Communities

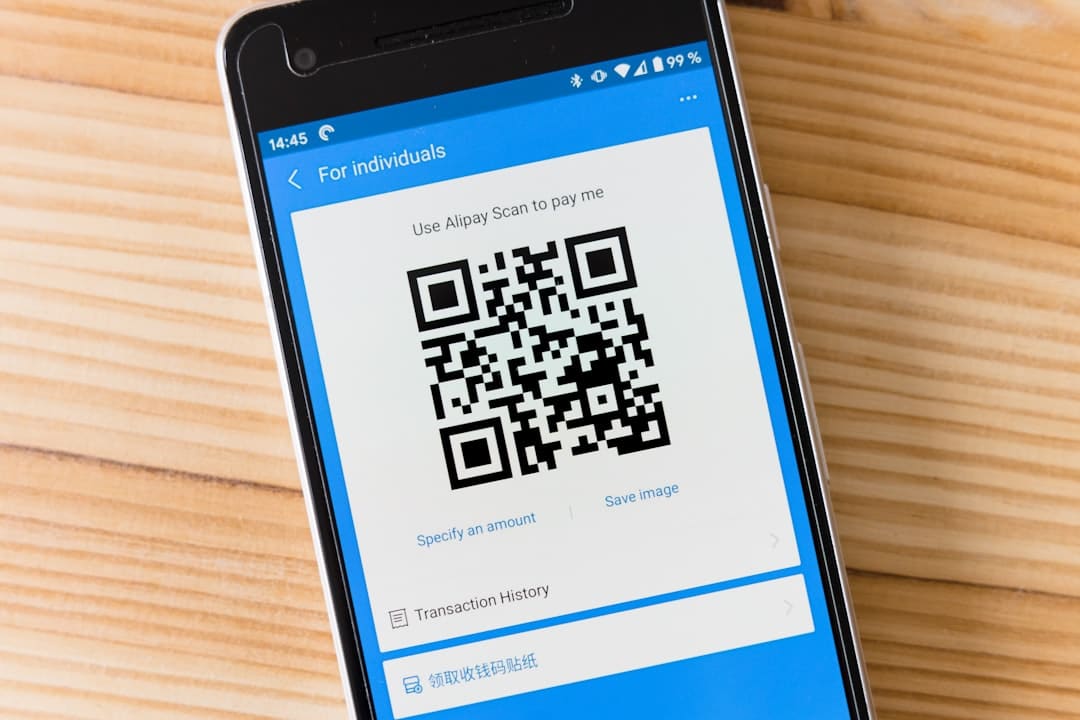

Mobile banking has emerged as a pivotal tool in bridging the financial gap for underserved communities across emerging markets. With the widespread adoption of mobile phones, even in regions with limited banking infrastructure, individuals can now access a range of financial services at their fingertips. Mobile banking applications allow users to perform transactions, pay bills, and transfer money without needing to visit a physical bank branch.

This convenience is particularly beneficial for those living in remote areas where traditional banking services may be scarce or non-existent. In addition to convenience, mobile banking fosters financial literacy and empowerment among underserved populations. Many mobile banking platforms incorporate educational resources that help users understand financial concepts, budgeting, and savings strategies.

For example, platforms like GCash in the Philippines not only facilitate transactions but also offer features that encourage users to save money and invest wisely. By equipping individuals with the knowledge and tools they need to manage their finances effectively, mobile banking plays a crucial role in promoting economic stability and resilience within communities that have historically been excluded from formal financial systems.

The Advantages and Challenges of Digital-First Banking in Emerging Economies

Digital-first banking offers numerous advantages for consumers and businesses alike in emerging economies. One of the most significant benefits is cost efficiency.

In contrast, digital-first banks can operate with lower overheads, allowing them to offer competitive fees and interest rates to customers. This cost advantage can translate into more affordable financial products for consumers, making banking services more accessible to a broader audience. However, despite its many advantages, digital-first banking also faces several challenges in emerging markets.

One major hurdle is the issue of digital literacy. While smartphone penetration is increasing, not all individuals possess the skills necessary to navigate digital banking platforms effectively. This gap in digital literacy can hinder the adoption of these services among certain demographics, particularly older adults or those with limited education.

Additionally, infrastructure challenges such as unreliable internet connectivity can impede access to digital banking services, further exacerbating inequalities in financial inclusion.

The Importance of Cybersecurity in the Expansion of Digital Banking Services

As digital-first banking services continue to expand in emerging markets, the importance of cybersecurity cannot be overstated. With an increasing number of users relying on digital platforms for their financial transactions, the risk of cyber threats has grown exponentially. Cybercriminals are constantly developing sophisticated methods to exploit vulnerabilities in digital systems, making it imperative for financial institutions to prioritize robust cybersecurity measures.

For instance, banks must implement multi-factor authentication processes and encryption protocols to safeguard sensitive customer data from unauthorized access. Moreover, building consumer trust is essential for the long-term success of digital banking services. Users must feel confident that their personal and financial information is secure when using these platforms.

Financial institutions can enhance trust by being transparent about their cybersecurity practices and promptly addressing any security breaches that may occur. Additionally, educating customers about safe online practices can empower them to take proactive steps in protecting their accounts from potential threats.

The Potential for Innovation and Growth in Emerging Markets through Digital Banking

The potential for innovation and growth in emerging markets through digital banking is immense. As technology continues to evolve, new opportunities are arising for financial service providers to develop innovative solutions tailored to the specific needs of local populations. For example, fintech companies are increasingly leveraging artificial intelligence (AI) and machine learning algorithms to create personalized financial products that cater to individual preferences and behaviors.

This level of customization can enhance customer satisfaction and loyalty while driving business growth.

By facilitating access to capital for small businesses and entrepreneurs, digital banking can stimulate job creation and economic diversification.

For instance, platforms that offer peer-to-peer lending enable individuals to invest directly in local businesses, fostering a sense of community investment and support. As these businesses thrive, they contribute to local economies and create a ripple effect that benefits entire communities.

The Shift towards Cashless Economies and the Role of Digital-First Banking Services

The global trend towards cashless economies is gaining momentum, particularly in emerging markets where digital-first banking services are playing a pivotal role. As consumers increasingly embrace electronic payment methods, traditional cash transactions are declining rapidly. Countries like Sweden have already made significant strides towards becoming cashless societies, while nations such as Nigeria are witnessing a similar shift driven by mobile payment solutions like Paystack and Flutterwave.

Digital-first banking services facilitate this transition by providing users with convenient alternatives to cash transactions. Mobile wallets allow individuals to make purchases at retail outlets or transfer money to friends and family with just a few taps on their smartphones. This shift not only enhances convenience but also promotes transparency in financial transactions, reducing the risks associated with cash handling such as theft or loss.

As more consumers adopt cashless payment methods, businesses are also incentivized to embrace digital solutions to meet evolving customer preferences.

The Future of Digital-First Banking in Emerging Markets: Opportunities and Trends

Looking ahead, the future of digital-first banking in emerging markets is poised for continued growth and innovation. As technology advances and consumer expectations evolve, financial institutions will need to adapt their offerings to remain competitive. One notable trend is the increasing integration of blockchain technology into digital banking services.

Blockchain’s decentralized nature can enhance security and transparency while reducing transaction costs associated with cross-border payments. Additionally, partnerships between traditional banks and fintech companies are likely to become more prevalent as both sectors recognize the value of collaboration. By leveraging each other’s strengths—traditional banks’ regulatory expertise and fintechs’ technological agility—these partnerships can lead to the development of innovative products that cater to diverse consumer needs.

Furthermore, as sustainability becomes an increasingly important consideration for consumers worldwide, digital-first banks may also focus on offering eco-friendly financial products that align with socially responsible investing principles. This shift towards sustainability could attract a new generation of customers who prioritize ethical considerations when choosing financial services. In conclusion, the rise of digital-first banking services in emerging markets represents a transformative shift in how individuals access financial services.

With technology driving financial inclusion and innovation, these markets are well-positioned for growth as they navigate the challenges and opportunities presented by this new era of banking.

A related article to How Digital-First Banking Services Are Expanding in Emerging Markets is “The Best Software for Social Media Management in 2023” which discusses the importance of utilizing social media management tools to enhance online presence and engagement. To learn more about the best software options for social media management, you can check out the article here.

FAQs

What are digital-first banking services?

Digital-first banking services are financial services that prioritize digital channels such as mobile apps, online banking platforms, and digital wallets for customer interactions and transactions. These services often offer a seamless and convenient way for customers to manage their finances without the need for physical bank branches.

How are digital-first banking services expanding in emerging markets?

Digital-first banking services are expanding in emerging markets due to the increasing penetration of smartphones and internet connectivity. Many people in emerging markets have limited access to traditional banking services, making digital-first banking a viable and convenient alternative. Additionally, the lower operating costs of digital-first banks allow them to reach underserved populations in emerging markets.

What are the benefits of digital-first banking services for consumers in emerging markets?

Consumers in emerging markets benefit from digital-first banking services through increased accessibility, lower fees, and a wider range of financial products and services. These services also provide a more convenient and efficient way for consumers to manage their finances, especially in areas where traditional banking infrastructure is limited.

What challenges do digital-first banking services face in expanding in emerging markets?

Challenges for digital-first banking services in emerging markets include building trust among consumers who are accustomed to traditional banking, addressing regulatory and compliance issues, and ensuring reliable and secure digital infrastructure. Additionally, reaching populations with limited digital literacy and access to smartphones or internet connectivity can be a barrier to expansion.