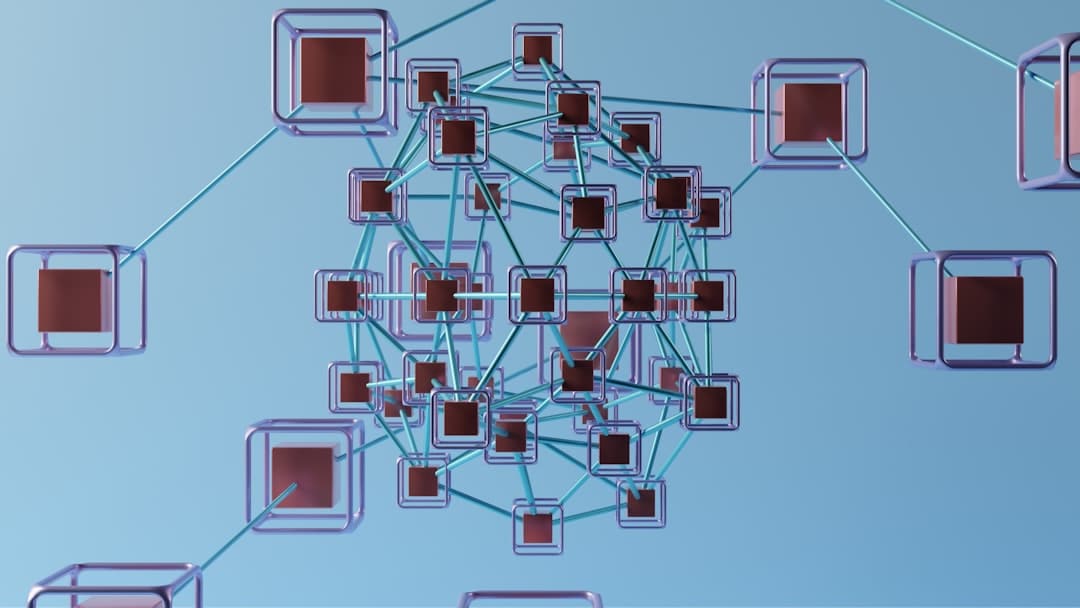

In recent years, the blockchain landscape has witnessed a significant evolution, marked by the emergence of cross-chain bridges. These innovative solutions have gained traction as they address one of the most pressing challenges in the blockchain ecosystem: interoperability. As various blockchain networks proliferate, each with its unique features, protocols, and communities, the need for seamless communication and interaction between these disparate systems has become increasingly apparent.

Cross-chain bridges serve as vital conduits that facilitate the transfer of assets and data across different blockchain networks, thereby enhancing the overall functionality and utility of decentralized applications (dApps). The rise of cross-chain bridges can be attributed to several factors, including the growing demand for decentralized finance (DeFi) applications and the increasing complexity of blockchain ecosystems. As users seek to leverage the advantages of multiple blockchains—such as lower transaction fees, faster processing times, or specific functionalities—cross-chain bridges have emerged as essential tools for enabling this multi-chain experience.

By allowing users to move assets freely between chains, these bridges not only enhance liquidity but also foster a more interconnected and collaborative blockchain environment. This trend is indicative of a broader movement towards a more inclusive and versatile blockchain ecosystem, where users can harness the strengths of various networks without being confined to a single platform.

Key Takeaways

- Cross-chain bridges are becoming increasingly important in blockchain technology, allowing different blockchains to communicate and share data.

- Interoperability in blockchain refers to the ability of different blockchains to work together seamlessly, enabling the transfer of assets and information across different networks.

- Cross-chain bridges play a crucial role in enabling interconnectivity between different blockchains, allowing for the seamless transfer of assets and data.

- There are different types of cross-chain bridges, including federated bridges, decentralized bridges, and wrapped tokens, each with its own unique features and functionalities.

- While cross-chain bridges offer numerous benefits, they also come with challenges and limitations, such as security risks and potential centralization issues.

Understanding the Concept of Interoperability in Blockchain

Interoperability in blockchain refers to the ability of different blockchain networks to communicate and interact with one another seamlessly. This concept is crucial for the growth and adoption of blockchain technology, as it allows for the exchange of information and assets across various platforms. Without interoperability, blockchains operate in silos, limiting their potential and hindering the development of innovative applications that could benefit from cross-chain interactions.

The lack of interoperability can lead to fragmentation within the ecosystem, where users are unable to leverage the full capabilities of multiple blockchains. To illustrate the importance of interoperability, consider a scenario where a user holds assets on Ethereum but wishes to utilize a DeFi application built on Binance Smart Chain (BSC). Without a cross-chain solution, this user would face significant barriers in transferring their assets between these two networks.

Interoperability enables users to engage with diverse applications and services across different blockchains, thereby enhancing their overall experience and expanding their options. Furthermore, it fosters collaboration among developers and projects, encouraging them to build solutions that can operate across multiple platforms, ultimately driving innovation within the blockchain space.

The Role of Cross-Chain Bridges in Enabling Interconnectivity

Cross-chain bridges play a pivotal role in enabling interconnectivity among various blockchain networks. By acting as intermediaries that facilitate the transfer of assets and data between chains, these bridges help to overcome the inherent limitations posed by isolated blockchain environments. They allow users to move tokens from one blockchain to another while maintaining the security and integrity of their assets.

This capability is essential for creating a more cohesive ecosystem where users can access a wider range of services and applications. One of the primary functions of cross-chain bridges is to provide liquidity across different networks. For instance, when users transfer tokens from Ethereum to a less congested network like Polygon, they can take advantage of lower transaction fees and faster processing times.

This not only benefits individual users but also enhances the overall liquidity of both networks involved in the transaction. Additionally, cross-chain bridges enable developers to create dApps that can tap into resources from multiple blockchains, leading to more robust and feature-rich applications. By fostering interconnectivity, cross-chain bridges contribute significantly to the evolution of decentralized ecosystems that prioritize user experience and accessibility.

Exploring the Different Types of Cross-Chain Bridges

Cross-chain bridges can be categorized into several types based on their underlying mechanisms and functionalities. One common type is the custodial bridge, which relies on a centralized entity to manage the transfer of assets between blockchains. In this model, users deposit their tokens into a smart contract controlled by the bridge operator, who then issues equivalent tokens on the destination chain.

While custodial bridges can offer faster transaction times and simplified processes, they introduce a level of trust dependency on the bridge operator. On the other hand, non-custodial bridges operate without a central authority, allowing users to maintain control over their assets throughout the transfer process. These bridges utilize smart contracts to facilitate transactions directly between users on different chains.

An example of this is the RenBridge, which allows users to transfer Bitcoin onto Ethereum without relying on a centralized intermediary. Non-custodial bridges enhance security by minimizing trust assumptions but may involve more complex processes for users unfamiliar with blockchain technology. Another emerging category is wrapped tokens, which represent an asset from one blockchain on another chain.

For instance, Wrapped Bitcoin (WBTC) allows Bitcoin holders to use their assets within the Ethereum ecosystem by creating an ERC-20 token that is backed 1:1 by Bitcoin held in custody. This approach not only enhances liquidity but also enables Bitcoin holders to participate in DeFi activities on Ethereum.

Challenges and Limitations of Cross-Chain Bridges

Despite their potential benefits, cross-chain bridges face several challenges and limitations that must be addressed for widespread adoption. One significant concern is security; custodial bridges are particularly vulnerable to hacks or mismanagement by operators, which can result in substantial losses for users. Non-custodial solutions also face risks related to smart contract vulnerabilities or exploits that could compromise user funds during transfers.

Another challenge is scalability. As more users engage with cross-chain bridges, network congestion can lead to slower transaction times and higher fees. This issue is exacerbated when multiple blockchains experience high demand simultaneously, creating bottlenecks that hinder efficient asset transfers.

Additionally, interoperability standards are still evolving, leading to inconsistencies in how different blockchains communicate with one another. The lack of universally accepted protocols can complicate the development of cross-chain solutions and limit their effectiveness. Moreover, regulatory uncertainties surrounding cryptocurrencies and blockchain technology pose challenges for cross-chain bridges.

As governments around the world grapple with how to regulate digital assets, compliance requirements may impact how these bridges operate and interact with users. Navigating this complex regulatory landscape will be crucial for ensuring that cross-chain bridges can function effectively while adhering to legal standards.

The Impact of Cross-Chain Bridges on Decentralized Finance (DeFi)

Cross-chain bridges have had a profound impact on the decentralized finance (DeFi) sector by enabling greater liquidity and accessibility across various platforms. DeFi applications often rely on liquidity pools to facilitate trading and lending activities; therefore, cross-chain bridges allow users to bring assets from one blockchain into another DeFi ecosystem seamlessly. This influx of liquidity can enhance trading volumes and improve price stability across different platforms.

For example, consider a user who wants to provide liquidity on a decentralized exchange (DEX) built on Avalanche but holds assets on Ethereum. By utilizing a cross-chain bridge, this user can transfer their Ethereum-based tokens to Avalanche quickly and efficiently, allowing them to participate in yield farming or trading opportunities without significant delays or costs associated with traditional methods. This capability not only benefits individual users but also strengthens the overall DeFi landscape by promoting competition among platforms and encouraging innovation.

Furthermore, cross-chain bridges enable DeFi projects to tap into diverse user bases across multiple blockchains. By allowing users from different ecosystems to interact with their services, these projects can expand their reach and attract new participants. This interconnectivity fosters collaboration among developers and encourages them to create innovative solutions that leverage the strengths of various blockchains.

Future Developments and Innovations in Cross-Chain Bridges

As the demand for interoperability continues to grow, we can expect significant developments and innovations in cross-chain bridge technology. One area ripe for advancement is the enhancement of security protocols. Developers are likely to focus on creating more robust mechanisms that minimize risks associated with asset transfers while ensuring user funds remain secure throughout the process.

This could involve implementing advanced cryptographic techniques or utilizing decentralized governance models that distribute control among multiple stakeholders. Another promising avenue for innovation lies in improving user experience. Many current cross-chain solutions require technical knowledge that may deter less experienced users from engaging with them.

Future developments may prioritize simplifying interfaces and streamlining processes to make cross-chain transactions more accessible to a broader audience. This could involve integrating user-friendly wallets or creating intuitive dashboards that guide users through asset transfers seamlessly. Additionally, we may see increased collaboration among blockchain projects aimed at establishing universal interoperability standards.

Initiatives like Polkadot and Cosmos are already working towards creating ecosystems where different blockchains can communicate effectively with one another. As these efforts gain traction, we could witness a paradigm shift in how cross-chain bridges operate, leading to more efficient and standardized solutions that benefit all participants in the blockchain ecosystem.

The Importance of Cross-Chain Bridges for the Future of Blockchain Ecosystem

Cross-chain bridges are poised to play a crucial role in shaping the future of the blockchain ecosystem by fostering interconnectivity and collaboration among diverse networks. As more projects emerge across various blockchains, the ability to transfer assets and data seamlessly will become increasingly vital for driving innovation and adoption within the space. Cross-chain bridges not only enhance liquidity but also empower users by providing them with greater flexibility in managing their digital assets.

Moreover, as decentralized finance continues to evolve, cross-chain bridges will be instrumental in creating a more inclusive financial landscape where users can access a wide range of services regardless of their preferred blockchain platform.

In conclusion, as we look ahead at the future of blockchain technology, it is clear that cross-chain bridges will be integral to realizing its full potential.

By enabling interoperability and fostering collaboration among diverse ecosystems, these solutions will help create a more interconnected and resilient blockchain landscape that benefits all participants involved.

If you are interested in exploring different niches for affiliate marketing in 2023, you may want to check out this article on the best niche for affiliate marketing in 2023. This article discusses how to stay stylish with Wear OS by Google, which can be a great way to attract potential customers and increase your affiliate marketing revenue. Additionally, Enicomp.com offers a variety of resources and information on blockchain technology, including how cross-chain bridges are enabling blockchain interconnectivity.

FAQs

What is a cross-chain bridge?

A cross-chain bridge is a technology that allows different blockchain networks to communicate and transfer assets or data between each other.

How do cross-chain bridges enable blockchain interconnectivity?

Cross-chain bridges enable blockchain interconnectivity by creating a link between different blockchain networks, allowing them to share information and assets seamlessly.

What are the benefits of cross-chain bridges?

The benefits of cross-chain bridges include increased interoperability between different blockchain networks, improved liquidity and accessibility for users, and the ability to leverage the unique features of multiple blockchains.

How do cross-chain bridges work?

Cross-chain bridges work by using a combination of smart contracts, oracles, and other technologies to facilitate the transfer of assets or data between different blockchain networks.

What are some examples of cross-chain bridges in use?

Examples of cross-chain bridges include projects like Polkadot, Cosmos, and Chainlink, which are all working to enable interoperability between different blockchain networks.