Biometrics is a technology that uses unique physical and behavioral characteristics to identify and authenticate individuals. In recent years, biometric authentication has gained popularity as a secure and convenient method for verifying a person’s identity. This technology has been widely adopted in various industries, including online payments, to enhance security and streamline the authentication process.

With the increasing number of online transactions, the need for robust security measures has become more critical than ever. Biometric authentication offers a promising solution to address the growing concerns related to fraud and identity theft in online payments. The use of biometrics in online payments involves capturing and analyzing an individual’s unique biological traits, such as fingerprints, facial features, iris patterns, voice, and even behavioral characteristics like typing patterns and gait.

These biometric data are then used to create a digital template that can be compared with the user’s biometric information stored in a secure database. When a user initiates an online payment, they can verify their identity by providing a biometric sample, which is then compared with the stored template to grant access to the payment system. This process not only enhances security but also offers a seamless and user-friendly experience for consumers.

As the demand for secure and convenient online payment methods continues to grow, biometric authentication is poised to play a significant role in shaping the future of online payments.

Key Takeaways

- Biometrics in online payments provides a secure and convenient way to authenticate users.

- Advantages of biometric authentication include increased security, reduced fraud, and improved user experience.

- Different types of biometric authentication include fingerprint recognition, facial recognition, iris scanning, voice recognition, and behavioral biometrics.

- Biometrics play a crucial role in preventing fraud and identity theft by providing a unique and secure way to verify a user’s identity.

- The integration of biometrics in online payment systems is becoming more widespread, with many companies adopting biometric authentication methods.

- The future of biometrics in online payments looks promising, with advancements in technology and increased adoption by consumers and businesses.

- Potential challenges and concerns with biometric authentication include privacy issues, data security, and the need for standardization and regulation.

The Advantages of Biometric Authentication

Biometric authentication offers several advantages over traditional methods of identity verification, particularly in the context of online payments. One of the key benefits of biometrics is its ability to provide a high level of security. Unlike passwords or PINs, which can be easily forgotten, stolen, or shared, biometric traits are unique to each individual and cannot be easily replicated or compromised.

This makes it extremely difficult for unauthorized users to gain access to sensitive financial information, reducing the risk of fraud and identity theft in online payments. In addition to security, biometric authentication also offers a convenient and user-friendly experience for consumers. With biometrics, users no longer need to remember complex passwords or carry physical tokens for authentication.

Instead, they can simply use their unique biological traits, such as fingerprints or facial features, to verify their identity and complete online transactions quickly and securely. This not only simplifies the authentication process but also enhances the overall user experience, leading to higher customer satisfaction and increased trust in online payment systems. Furthermore, biometric authentication can also help reduce operational costs for businesses by minimizing the need for password resets and customer support related to forgotten credentials.

Overall, the advantages of biometric authentication make it an attractive solution for enhancing security and convenience in online payments.

The Different Types of Biometric Authentication

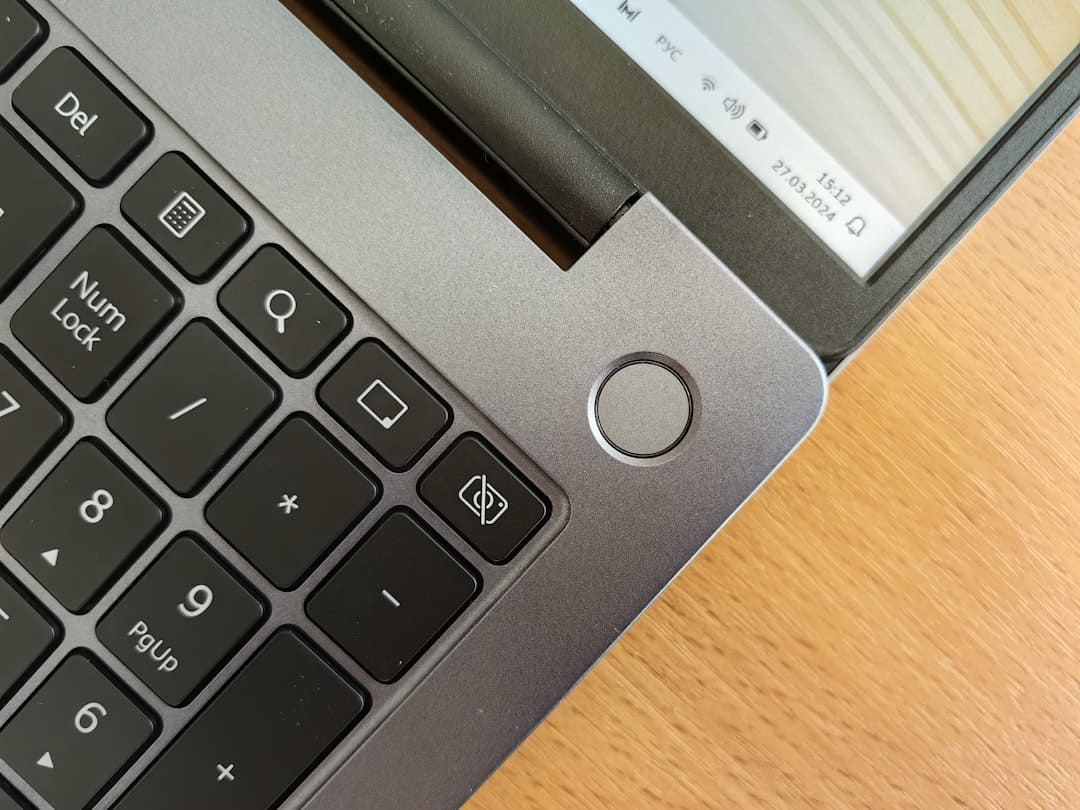

Biometric authentication encompasses a wide range of technologies that leverage different biological traits for identity verification. Some of the most commonly used types of biometric authentication include fingerprint recognition, facial recognition, iris scanning, voice recognition, and behavioral biometrics. Fingerprint recognition is one of the oldest and most widely adopted forms of biometric authentication, which involves capturing and analyzing the unique patterns of ridges and valleys on an individual’s fingertips.

This technology is commonly used in smartphones and other devices for unlocking screens and authorizing payments. Facial recognition technology uses algorithms to analyze facial features such as the distance between the eyes, nose, and mouth to create a unique facial template for each individual. This type of biometric authentication has gained popularity in recent years due to its convenience and accuracy in verifying identity.

Iris scanning is another form of biometric authentication that involves capturing high-resolution images of the iris patterns in an individual’s eyes. This technology offers a high level of accuracy and is often used in high-security environments such as border control and government facilities. Voice recognition technology analyzes an individual’s unique vocal characteristics, such as pitch, tone, and cadence, to create a voiceprint for authentication purposes.

This type of biometric authentication is commonly used in call centers and telephone banking services. Behavioral biometrics involve analyzing an individual’s unique behavioral patterns, such as typing speed, keystroke dynamics, and mouse movements, to verify their identity. This technology offers continuous authentication by monitoring user behavior throughout an online session, adding an extra layer of security to online transactions.

The different types of biometric authentication offer diverse options for businesses to implement secure and convenient identity verification methods in online payments.

The Role of Biometrics in Preventing Fraud and Identity Theft

Fraud and identity theft are significant concerns in online payments, posing risks to both consumers and businesses. Biometric authentication plays a crucial role in preventing fraud and identity theft by providing a highly secure method for verifying an individual’s identity. Unlike traditional authentication methods such as passwords or PINs, which can be easily compromised through phishing attacks or data breaches, biometric traits are unique to each individual and cannot be easily replicated or stolen.

This makes it extremely difficult for fraudsters to gain unauthorized access to sensitive financial information, reducing the risk of fraudulent transactions and unauthorized account access. Furthermore, biometric authentication offers an additional layer of security by providing continuous verification throughout an online session. Behavioral biometrics, for example, can monitor user behavior in real-time to detect any anomalies or suspicious activities that may indicate fraudulent behavior.

This proactive approach to security helps businesses identify and prevent fraudulent transactions before they occur, minimizing potential losses and protecting both consumers and businesses from financial harm. By leveraging the unique biological traits of individuals, biometric authentication plays a critical role in enhancing the security of online payments and mitigating the risks associated with fraud and identity theft.

The Integration of Biometrics in Online Payment Systems

The integration of biometrics in online payment systems has gained momentum as businesses seek to enhance security and streamline the authentication process for consumers. Many financial institutions and payment service providers have started implementing biometric authentication methods such as fingerprint recognition, facial recognition, and voice recognition into their online payment platforms. This allows users to verify their identity using their unique biological traits, providing a secure and convenient method for authorizing transactions without relying on traditional passwords or PINs.

In addition to traditional online payment systems, biometric authentication is also being integrated into emerging payment technologies such as mobile wallets and contactless payments. Mobile devices equipped with fingerprint sensors or facial recognition cameras enable users to authenticate transactions securely using their biometric data. Similarly, contactless payment methods such as near field communication (NFC) technology can leverage biometric authentication to authorize transactions with a simple tap or glance, offering a seamless and secure payment experience for consumers.

The integration of biometrics in online payment systems not only enhances security but also contributes to the widespread adoption of digital payment methods by providing a user-friendly and frictionless experience for consumers.

The Future of Biometrics in Online Payments

The future of biometrics in online payments looks promising as advancements in technology continue to drive innovation in identity verification methods. As biometric authentication becomes more widespread and accessible, it is expected to play an increasingly significant role in shaping the future of online payments. One area of development is the use of multimodal biometrics, which combines multiple types of biometric traits for enhanced accuracy and security.

For example, combining fingerprint recognition with facial recognition can provide a more robust method for verifying an individual’s identity, reducing the risk of false positives or unauthorized access. Another trend in the future of biometrics is the integration of artificial intelligence (AI) and machine learning algorithms to improve the accuracy and reliability of biometric authentication systems. AI-powered biometric solutions can adapt to changes in an individual’s biological traits over time, ensuring consistent and reliable performance in various environmental conditions.

Furthermore, advancements in sensor technology are expected to drive the development of more compact and cost-effective biometric devices, making it easier for businesses to implement biometric authentication in their online payment systems. The future of biometrics in online payments also holds potential for expanding its use beyond traditional digital platforms. As the Internet of Things (IoT) continues to grow, biometric authentication can be integrated into connected devices such as smart home appliances, wearable devices, and even vehicles to enable secure and seamless payment experiences across various touchpoints.

Overall, the future of biometrics in online payments is characterized by continuous innovation and expansion into new applications, offering enhanced security and convenience for consumers in the digital economy.

The Potential Challenges and Concerns with Biometric Authentication

While biometric authentication offers numerous benefits for enhancing security and convenience in online payments, it also raises potential challenges and concerns that need to be addressed. One major concern is privacy and data protection related to the collection and storage of biometric data. As businesses collect and store individuals’ unique biological traits for authentication purposes, there is a risk of unauthorized access or misuse of this sensitive information.

To address this concern, businesses must implement robust security measures to protect biometric data from unauthorized access or breaches. Another challenge with biometric authentication is the potential for false positives or false negatives during the verification process. Factors such as environmental conditions, changes in an individual’s biological traits over time, or variations in sensor accuracy can lead to errors in identifying or verifying an individual’s identity.

Businesses must carefully evaluate the reliability and accuracy of their biometric authentication systems to minimize the risk of false results that could impact user experience and trust in online payment systems. Furthermore, there are concerns related to interoperability and standardization of biometric authentication across different platforms and devices. As businesses seek to implement biometrics in various digital touchpoints such as mobile devices, computers, and IoT devices, ensuring seamless interoperability and consistent user experience becomes essential.

Standardization efforts are needed to establish common protocols and guidelines for integrating biometric authentication into diverse digital ecosystems. In conclusion, while biometric authentication offers significant potential for enhancing security and convenience in online payments, businesses must address potential challenges related to privacy, accuracy, and interoperability to ensure the successful adoption of this technology. By implementing robust security measures, leveraging advancements in sensor technology and AI-powered algorithms, and adhering to privacy regulations, businesses can harness the benefits of biometrics while mitigating potential concerns associated with this innovative form of identity verification.

If you’re interested in how technology is shaping various industries, you might find the article on the best software for NDIS providers quite enlightening. While it focuses on healthcare and support services, it parallels discussions on biometrics in online payments by highlighting how specialized software can enhance security and efficiency. Both sectors are increasingly relying on advanced technology to improve user experience and safety, making this a relevant read for those curious about technological integration in different fields.

FAQs

What are biometrics?

Biometrics are biological measurements or physical characteristics that can be used to identify individuals. These can include fingerprints, facial recognition, iris scans, and voice recognition.

How are biometrics changing online payments?

Biometrics are changing online payments by providing a more secure and convenient way for individuals to authenticate their identity when making transactions. This can help reduce fraud and improve the overall user experience.

What are the benefits of using biometrics for online payments?

Using biometrics for online payments can provide increased security, as biometric data is unique to each individual and difficult to replicate. It also offers a more convenient and seamless user experience, as users no longer need to remember passwords or carry physical cards.

What are some examples of biometric authentication methods for online payments?

Examples of biometric authentication methods for online payments include fingerprint scanners on mobile devices, facial recognition technology, iris scans, and voice recognition software.

Are there any concerns about using biometrics for online payments?

Some concerns about using biometrics for online payments include potential privacy issues, the risk of biometric data being stolen or hacked, and the need for clear regulations and standards to ensure the secure use of biometric technology.