The advent of artificial intelligence (AI) has revolutionized numerous sectors, with financial services being one of the most significantly impacted. AI-powered risk assessment models have emerged as a critical tool for lenders, enabling them to evaluate the creditworthiness of borrowers with unprecedented accuracy and efficiency. These models leverage vast amounts of data, employing machine learning algorithms to identify patterns and predict outcomes that traditional methods might overlook.

By integrating AI into risk assessment, financial institutions can not only streamline their operations but also enhance their decision-making processes, ultimately leading to more informed lending practices. The traditional approach to risk assessment often relied on static credit scores and historical data, which could be limiting and sometimes misleading. In contrast, AI models can analyze a broader spectrum of information, including alternative data sources such as social media activity, transaction histories, and even behavioral patterns.

This shift towards a more dynamic and comprehensive evaluation framework allows lenders to make better-informed decisions, reducing the likelihood of defaults while simultaneously expanding access to credit for underserved populations. As the financial landscape continues to evolve, understanding the intricacies of AI-powered risk assessment models becomes essential for stakeholders aiming to navigate this new terrain effectively.

Key Takeaways

- AI-powered risk assessment models use advanced algorithms to analyze large amounts of data and make lending decisions.

- AI has significantly impacted lending decisions by improving accuracy, efficiency, and speed of risk assessment.

- The advantages of AI-powered risk assessment models include better risk prediction, reduced human bias, and improved customer experience.

- Challenges and limitations of AI in lending decisions include data privacy concerns, algorithmic bias, and the need for human oversight.

- Case studies have shown successful implementation of AI in lending, leading to better loan approval rates and reduced default rates.

The Impact of AI on Lending Decisions

Streamlining Lending Processes

AI has streamlined the lending process by automating data analysis and risk evaluation. This has enabled lenders to respond swiftly to market demands and make instant lending decisions. For instance, algorithms can process applications in real-time, providing instant feedback to applicants and enhancing customer satisfaction.

Uncovering Hidden Insights

AI’s ability to analyze vast datasets has enabled lenders to identify trends and correlations that may not be immediately apparent through conventional methods. Machine learning models can uncover insights about borrower behavior based on demographic factors, economic conditions, and even regional trends. This level of granularity allows lenders to tailor their offerings more precisely, creating personalized loan products that align with the specific needs of different customer segments.

Fostering a More Inclusive Financial Ecosystem

The use of AI in lending decisions has not only improved the accuracy of lending decisions but also fostered a more inclusive financial ecosystem. By enabling access to credit for individuals who may have been previously overlooked, AI has promoted financial inclusion and reduced inequality. As a result, AI has become an essential tool for lenders seeking to make a positive impact on the financial industry.

Advantages of AI-Powered Risk Assessment Models

The advantages of AI-powered risk assessment models are manifold, particularly in enhancing the precision and efficiency of lending decisions. One of the most significant benefits is the ability to process and analyze large volumes of data at an unprecedented speed. Traditional risk assessment methods often rely on limited datasets, which can lead to incomplete evaluations.

In contrast, AI models can incorporate diverse data sources—ranging from credit histories to social media interactions—allowing for a more holistic view of a borrower’s financial behavior. This comprehensive analysis not only improves the accuracy of risk predictions but also helps lenders identify potential red flags that might otherwise go unnoticed. Another key advantage is the reduction of bias in lending decisions.

Traditional credit scoring systems have been criticized for perpetuating systemic biases that disadvantage certain demographic groups. AI-powered models can be designed to mitigate these biases by focusing on relevant data points rather than relying solely on historical credit performance. For instance, by incorporating alternative data sources such as utility payments or rental history, lenders can gain insights into the creditworthiness of individuals who may lack traditional credit histories.

This approach not only broadens access to credit but also promotes fairness in lending practices, aligning with the growing emphasis on social responsibility within the financial sector.

Challenges and Limitations of AI in Lending Decisions

Despite the numerous advantages associated with AI-powered risk assessment models, several challenges and limitations persist that warrant careful consideration. One significant concern is the potential for algorithmic bias, which can arise if the data used to train AI models reflects existing prejudices or inequalities. If historical data contains biases—such as underrepresentation of certain demographic groups—the resulting AI model may inadvertently perpetuate these biases in its predictions.

This issue underscores the importance of ensuring that training datasets are diverse and representative, as well as implementing robust monitoring mechanisms to detect and address any biases that may emerge over time. Additionally, the opacity of many AI algorithms poses a challenge for transparency and accountability in lending decisions. Many machine learning models operate as “black boxes,” making it difficult for lenders to understand how specific decisions are made.

This lack of interpretability can lead to challenges in regulatory compliance and customer trust. Borrowers may find it difficult to contest decisions made by AI systems if they do not understand the rationale behind them. As a result, financial institutions must prioritize developing explainable AI models that provide clear insights into how decisions are reached while maintaining compliance with regulatory standards.

Case Studies of Successful Implementation of AI in Lending

Several financial institutions have successfully implemented AI-powered risk assessment models, demonstrating their effectiveness in enhancing lending practices. One notable example is ZestFinance, a fintech company that utilizes machine learning algorithms to assess credit risk for underserved borrowers. By analyzing alternative data sources such as mobile phone usage patterns and online behavior, ZestFinance has been able to provide loans to individuals who would typically be denied credit based on traditional scoring methods.

Another compelling case is that of JPMorgan Chase, which has integrated AI into its underwriting processes. The bank employs machine learning algorithms to analyze vast amounts of data from various sources, allowing it to make more accurate predictions about borrower risk.

By leveraging these insights, JPMorgan Chase has streamlined its loan approval process, reducing turnaround times significantly while maintaining a strong focus on risk management. The success of these implementations highlights the transformative potential of AI in lending and serves as a model for other institutions looking to enhance their risk assessment capabilities.

Ethical Considerations in AI-Powered Risk Assessment Models

The integration of AI into risk assessment models raises several ethical considerations that must be addressed to ensure responsible use of technology in lending practices. One primary concern is the potential for discrimination against marginalized groups if AI systems are not designed with fairness in mind. As previously mentioned, algorithmic bias can lead to unequal treatment of borrowers based on race, gender, or socioeconomic status.

Financial institutions must take proactive steps to audit their algorithms regularly and implement measures that promote equity in lending decisions. Furthermore, data privacy is a critical ethical consideration in the deployment of AI-powered risk assessment models. The use of alternative data sources raises questions about consent and the extent to which individuals are aware of how their information is being used.

Lenders must prioritize transparency by clearly communicating their data collection practices and ensuring that borrowers have control over their personal information.

Future Trends in AI-Powered Lending Decisions

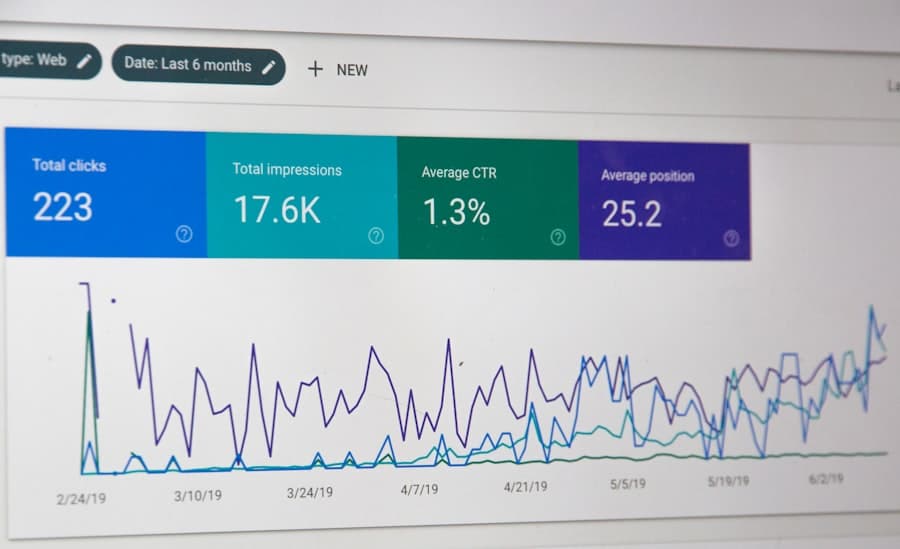

As technology continues to advance, several trends are likely to shape the future landscape of AI-powered lending decisions. One emerging trend is the increasing use of real-time data analytics in risk assessment processes. With the proliferation of digital transactions and online interactions, lenders can access up-to-the-minute information about borrowers’ financial behaviors.

This capability will enable institutions to make more timely and informed lending decisions while adapting quickly to changing market conditions. Another trend is the growing emphasis on collaboration between traditional financial institutions and fintech companies specializing in AI solutions. Partnerships between established banks and innovative startups can facilitate knowledge sharing and accelerate the adoption of cutting-edge technologies in lending practices.

By leveraging each other’s strengths—such as banks’ regulatory expertise and fintechs’ technological agility—these collaborations can lead to more effective risk assessment models that benefit both lenders and borrowers alike.

The Role of AI in Shaping the Future of Lending

AI-powered risk assessment models are poised to play a pivotal role in shaping the future of lending by enhancing decision-making processes and promoting inclusivity within the financial ecosystem. As institutions increasingly adopt these technologies, they will be better equipped to navigate complex market dynamics while addressing the diverse needs of borrowers. However, it is crucial for stakeholders to remain vigilant about ethical considerations and potential biases inherent in AI systems.

The journey toward fully realizing the potential of AI in lending will require ongoing collaboration among industry players, regulators, and consumers alike. By prioritizing transparency, fairness, and accountability in their practices, financial institutions can harness the power of AI responsibly while fostering trust among their customers. As we look ahead, it is clear that AI will continue to be a transformative force in lending, driving innovation and reshaping how we think about creditworthiness and access to finance.

A related article to How AI-Powered Risk Assessment Models Are Improving Lending Decisions is The Best Software for Video Editing in 2023. This article discusses the top software options available for video editing in the upcoming year, providing valuable insights for professionals in the field. By utilizing advanced technology and innovative tools, video editors can enhance their workflow and produce high-quality content efficiently.

FAQs

What are AI-powered risk assessment models?

AI-powered risk assessment models are algorithms that use artificial intelligence and machine learning to analyze large amounts of data and predict the likelihood of a borrower defaulting on a loan. These models take into account various factors such as credit history, income, employment status, and other relevant data to assess the risk associated with lending to a particular individual or business.

How do AI-powered risk assessment models improve lending decisions?

AI-powered risk assessment models improve lending decisions by providing more accurate and reliable predictions of borrower risk. These models can analyze a wider range of data points and identify patterns and trends that may not be apparent to human underwriters. This allows lenders to make more informed decisions about who to lend to and at what terms, ultimately reducing the risk of default and improving overall loan performance.

What are the benefits of using AI-powered risk assessment models in lending?

Some of the benefits of using AI-powered risk assessment models in lending include improved accuracy in predicting borrower risk, faster decision-making processes, reduced operational costs, and increased access to credit for underserved populations. These models also help lenders comply with regulatory requirements and ensure fair and consistent lending practices.

Are there any potential drawbacks or limitations to AI-powered risk assessment models?

While AI-powered risk assessment models offer many benefits, there are also potential drawbacks and limitations to consider. These may include the risk of algorithmic bias, data privacy concerns, and the need for ongoing monitoring and validation of model performance. Additionally, these models may not capture all relevant factors that could impact borrower risk, and human oversight is still necessary to ensure fair and ethical lending practices.