The digital lending landscape has undergone a significant transformation in recent years, largely driven by advancements in artificial intelligence (AI). As traditional lending practices grapple with inefficiencies and a lack of personalization, AI emerges as a powerful tool that can streamline processes, enhance decision-making, and improve customer experiences. Digital lending platforms leverage AI technologies to analyze vast amounts of data, enabling them to make informed lending decisions quickly and accurately.

This shift not only benefits lenders by reducing operational costs and risks but also empowers borrowers with tailored financial solutions that meet their unique needs. AI’s integration into digital lending platforms is not merely a trend; it represents a fundamental change in how financial institutions operate. By harnessing machine learning algorithms and predictive analytics, these platforms can assess borrower profiles with unprecedented precision.

This capability allows lenders to move beyond traditional credit scoring methods, which often rely on limited data points and can inadvertently exclude deserving borrowers. Instead, AI enables a more holistic view of an applicant’s creditworthiness, taking into account alternative data sources such as transaction histories, social media activity, and even behavioral patterns. As a result, the lending process becomes more inclusive, fostering greater access to credit for a diverse range of consumers.

Key Takeaways

- AI is revolutionizing digital lending platforms by enabling more efficient and personalized loan recommendations.

- AI plays a crucial role in analyzing borrower data, allowing lenders to make more informed decisions and reduce the risk of default.

- Utilizing AI for risk assessment and credit scoring helps lenders to accurately evaluate the creditworthiness of borrowers.

- AI’s impact on personalized loan recommendations leads to more tailored and suitable offers for individual borrowers.

- Enhancing customer experience with AI-driven offers results in a more streamlined and user-friendly lending process.

The Role of AI in Analyzing Borrower Data

At the heart of AI’s impact on digital lending is its ability to analyze borrower data efficiently and effectively. Traditional methods of data analysis often involve manual processes that are time-consuming and prone to human error. In contrast, AI algorithms can process vast datasets in real-time, identifying patterns and trends that may not be immediately apparent to human analysts.

This capability is particularly valuable in the context of lending, where understanding a borrower’s financial behavior is crucial for making informed decisions. For instance, AI can analyze transaction data from a borrower’s bank accounts to assess spending habits, income stability, and overall financial health. By examining these factors, lenders can gain insights into a borrower’s ability to repay a loan, even if they have limited credit history.

Additionally, AI can incorporate external data sources such as utility payments or rental history, further enriching the analysis. This comprehensive approach allows lenders to create a more accurate profile of potential borrowers, ultimately leading to better lending decisions and reduced default rates. Moreover, the use of AI in data analysis extends beyond initial assessments.

Continuous monitoring of borrower behavior can provide lenders with ongoing insights into their clients’ financial situations. For example, if a borrower experiences a sudden drop in income or begins to exhibit risky spending patterns, AI systems can flag these changes for review.

Utilizing AI for Risk Assessment and Credit Scoring

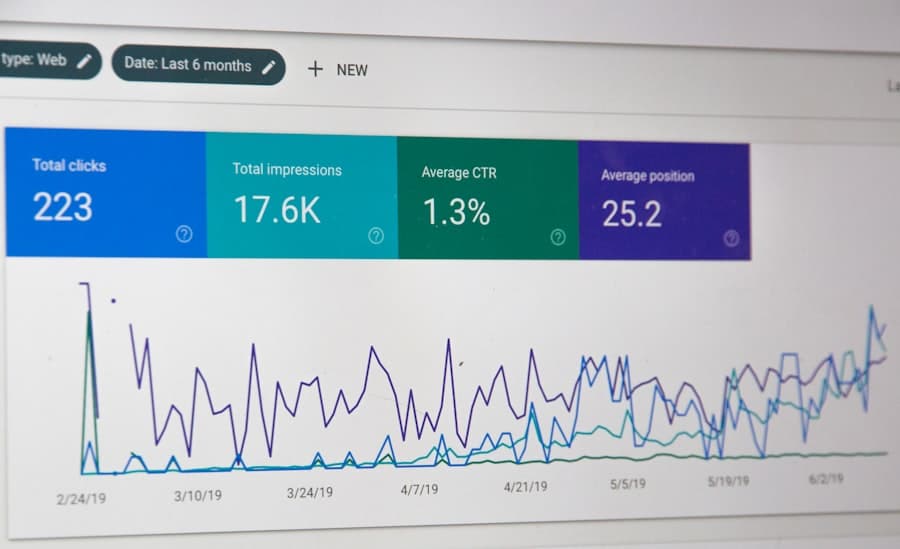

Risk assessment is a critical component of the lending process, as it directly influences the terms and conditions offered to borrowers. Traditional credit scoring models often rely heavily on historical credit data, which can lead to biases and inaccuracies. In contrast, AI-driven risk assessment models utilize a broader range of data points to evaluate creditworthiness more comprehensively.

By employing machine learning techniques, these models can adapt and improve over time, learning from new data inputs and borrower behaviors. One notable example of AI’s application in risk assessment is the use of alternative data sources to supplement traditional credit scores. For instance, companies like ZestFinance have developed algorithms that analyze non-traditional data such as mobile phone usage patterns and online shopping behaviors.

By incorporating these additional data points, lenders can identify creditworthy individuals who may have been overlooked by conventional scoring systems. This approach not only expands access to credit but also helps lenders make more informed decisions about risk. Furthermore, AI enhances the accuracy of risk assessment by enabling real-time analysis of borrower data.

Traditional models often rely on static information that may become outdated quickly. In contrast, AI systems can continuously update their assessments based on new information, allowing lenders to respond dynamically to changes in a borrower’s financial situation. This agility is particularly important in today’s fast-paced economic environment, where borrowers’ circumstances can shift rapidly due to unforeseen events such as job loss or economic downturns.

AI’s Impact on Personalized Loan Recommendations

Personalization has become a key differentiator in the competitive landscape of digital lending. Borrowers increasingly expect tailored solutions that align with their specific financial needs and goals. AI plays a pivotal role in delivering personalized loan recommendations by analyzing individual borrower profiles and matching them with suitable loan products.

This process goes beyond simply offering the lowest interest rate; it considers various factors such as loan amount, repayment terms, and borrower preferences. For example, an AI-driven lending platform might analyze a borrower’s financial history and current obligations to recommend a loan product that fits their budget while also addressing their long-term financial goals. If a borrower is looking for a personal loan to consolidate debt, the platform could suggest options with favorable terms that prioritize lower monthly payments or shorter repayment periods based on the borrower’s preferences.

This level of personalization not only enhances the borrower experience but also increases the likelihood of successful loan repayment. Moreover, AI’s ability to learn from user interactions further refines the personalization process over time. As borrowers engage with the platform—whether by applying for loans or providing feedback—AI algorithms can adjust their recommendations based on this new information.

This iterative learning process ensures that borrowers receive increasingly relevant suggestions that align with their evolving financial situations and preferences.

Enhancing Customer Experience with AI-Driven Offers

The customer experience is paramount in the digital lending space, where competition is fierce and borrowers have numerous options at their fingertips. AI-driven offers enhance this experience by providing borrowers with timely and relevant loan options tailored to their needs. By leveraging data analytics and machine learning algorithms, lenders can create targeted marketing campaigns that resonate with specific borrower segments.

For instance, an AI system might identify a group of borrowers who have recently experienced an increase in income or improved credit scores. Based on this analysis, the platform could generate personalized offers for higher loan amounts or lower interest rates, encouraging these borrowers to take advantage of their improved financial standing. This targeted approach not only increases conversion rates but also fosters a sense of loyalty among borrowers who feel understood and valued by their lenders.

Additionally, AI can facilitate seamless communication between lenders and borrowers throughout the loan application process. Chatbots powered by natural language processing can provide instant responses to borrower inquiries, guiding them through the application process and addressing any concerns they may have. This level of accessibility enhances the overall customer experience by reducing friction and ensuring that borrowers feel supported at every stage of their journey.

The Future of AI in Personalized Offers for Digital Lending

As technology continues to evolve, the future of AI in personalized offers for digital lending appears promising. Innovations in machine learning and data analytics will likely lead to even more sophisticated algorithms capable of predicting borrower behavior with greater accuracy. For instance, advancements in natural language processing could enable lenders to analyze unstructured data from social media or online reviews to gain deeper insights into borrower sentiment and preferences.

Moreover, the integration of AI with other emerging technologies such as blockchain could revolutionize the lending landscape further. Blockchain’s decentralized nature could enhance transparency and security in lending transactions while allowing for more efficient data sharing between parties. This synergy between AI and blockchain could lead to more streamlined processes and improved trust between lenders and borrowers.

Additionally, as regulatory frameworks around AI continue to develop, there will be opportunities for lenders to leverage these technologies responsibly while ensuring compliance with ethical standards. The focus on responsible AI usage will likely drive innovation in ways that prioritize fairness and inclusivity in lending practices.

Overcoming Challenges and Ethical Considerations in AI-Powered Personalized Offers

While the benefits of AI in digital lending are substantial, there are also challenges and ethical considerations that must be addressed. One significant concern is the potential for algorithmic bias in lending decisions. If AI systems are trained on historical data that reflects existing biases—such as discrimination against certain demographic groups—there is a risk that these biases will be perpetuated in automated lending processes.

To mitigate this risk, it is essential for lenders to implement rigorous testing and validation protocols for their algorithms. Transparency is another critical consideration when it comes to AI-powered personalized offers. Borrowers should have access to clear explanations regarding how their data is being used and how lending decisions are made.

This transparency fosters trust between lenders and borrowers while empowering individuals to make informed choices about their financial futures. Furthermore, as digital lending platforms collect vast amounts of personal data from borrowers, ensuring robust data privacy measures is paramount. Lenders must prioritize cybersecurity and adhere to regulations governing data protection to safeguard sensitive information from breaches or misuse.

The Benefits of AI-Enhanced Personalized Offers in Digital Lending Platforms

The integration of AI into digital lending platforms has ushered in a new era of personalized offers that cater to the unique needs of borrowers while enhancing operational efficiency for lenders. By leveraging advanced data analytics and machine learning algorithms, these platforms can analyze borrower profiles comprehensively, assess risk accurately, and deliver tailored loan recommendations that resonate with individual preferences. As the digital lending landscape continues to evolve, embracing responsible AI practices will be crucial for ensuring fairness and inclusivity in lending decisions.

By addressing challenges related to bias, transparency, and data privacy, lenders can harness the full potential of AI while fostering trust among borrowers. Ultimately, the benefits of AI-enhanced personalized offers extend beyond mere convenience; they represent a transformative shift towards more equitable access to credit for all consumers. As technology advances further, the future holds exciting possibilities for innovation in digital lending that prioritize both borrower needs and ethical considerations.

If you’re interested in learning more about how technology is impacting various industries, you may want to check out the article “An Original Home for Technology News and Reviews” on enicomp.com.

It’s a great resource for staying informed about the intersection of technology and business.

FAQs

What is AI?

AI, or artificial intelligence, refers to the simulation of human intelligence in machines that are programmed to think and act like humans. This includes tasks such as learning, problem-solving, and decision-making.

How is AI used in digital lending platforms?

AI is used in digital lending platforms to enhance personalized offers for users. It can analyze large amounts of data to assess a borrower’s creditworthiness, predict their ability to repay a loan, and tailor loan offers to their specific needs and financial situation.

What are the benefits of using AI for personalized offers in digital lending?

Using AI for personalized offers in digital lending platforms can lead to more accurate risk assessment, faster loan approval processes, and a better overall user experience. It can also help lenders reduce the risk of defaults and make more informed lending decisions.

Are there any potential drawbacks to using AI in digital lending platforms?

While AI can offer many benefits, there are potential drawbacks to consider, such as the risk of algorithmic bias and the need for ongoing monitoring and oversight to ensure fair and ethical lending practices.

How does AI enhance the user experience in digital lending platforms?

AI can enhance the user experience in digital lending platforms by providing personalized loan offers that are tailored to each user’s financial situation and needs. This can help users find the best loan options more quickly and easily.